Discover the best health insurance Maryland options for individuals and families. Learn how to compare plans, get financial assistance, and enroll easily through Maryland Health Connection.

Understanding Health Insurance in Maryland

If you live in Maryland, protecting your health is one of the most important things you can do for yourself and your family. That’s where health insurance Maryland comes in. Simply put, health insurance helps pay for doctor visits, hospital care, medicine, and emergencies, so you don’t have to carry the full cost alone. Life is unpredictable, and having the right Maryland health insurance can bring peace of mind when you need it most.

Many people feel confused when they first hear terms like plans, coverage, or premiums. Don’t worry—you’re not alone. This guide is here to make health insurance plans Maryland easy to understand, even if you’ve never had insurance before. Think of health insurance as a safety net. When something goes wrong, that net catches you and helps reduce stress, worry, and big medical bills.

Maryland offers several Maryland health coverage options designed to fit different needs and budgets. Whether you are working, self-employed, supporting a family, or between jobs, there are choices available for you. The state even runs its own marketplace called Maryland Health Connection, which helps people compare plans and find affordable options in one place.

Why does this matter so much? Because medical care can be expensive. A single emergency room visit can cost thousands of dollars. With affordable health insurance Maryland, many of those costs are shared, making care more reachable and less scary. Insurance also helps you get regular checkups, so small problems don’t turn into big ones.

This guide is made for real people—parents, students, workers, and anyone who wants to feel secure about their health. We’ll walk through health insurance providers in Maryland, explain how plans work, and help you learn how to get health insurance in Maryland step by step. No complicated talk. No confusing rules. Just clear help.

Overview of Health Insurance Options in Maryland

Now that you understand why health insurance Maryland matters, let’s talk about the different options you can choose from. Think of this like picking shoes—there isn’t just one kind. The right choice depends on your life, your budget, and your needs. The good news? Maryland health insurance offers several paths, so most people can find something that works for them.

First, there is employer-sponsored health insurance Maryland. If you work for a company, your job may offer health coverage as part of your benefits. This is one of the most common options because employers often help pay part of the cost. It can make health insurance plans Maryland more affordable and easier to manage.

Next, we have private health insurance Maryland. This option is popular with self-employed people, freelancers, or anyone whose job does not offer coverage. You buy a plan directly from health insurance providers in Maryland. These plans give you flexibility, but prices can vary, so comparing is very important.

Another major option is government-supported coverage. This includes Maryland Medicaid and CHIP Maryland. These programs are designed for low-income individuals, families, children, and some adults. If you qualify, you may get low income health insurance Maryland at very low cost—or even free. This type of Maryland health coverage can be life-changing for families who need reliable care.

Then there’s the state marketplace. Maryland runs its own official marketplace called Maryland Health Connection. This is where many people go to find affordable health insurance Maryland. You can compare plans side by side, see prices clearly, and check if you qualify for health insurance subsidies Maryland or a premium tax credit Maryland.

There are also individual health insurance Maryland and family health insurance Maryland plans. Individual plans are for one person, while family plans cover spouses and children under one policy. Many families use the marketplace to find the best health insurance plans in Maryland for families.

What Is Maryland Health Connection and How It Works

If you’re wondering where most people find health insurance Maryland, the answer is simple: Maryland Health Connection. This is the official health insurance marketplace created just for people who live in Maryland. Think of it as a one-stop shop where you can explore Maryland health insurance options safely and confidently.

Maryland Health Connection is run by the state, not a private company. That’s important because it means the information is trustworthy and designed to help you—not pressure you. When you visit the marketplace, you can compare different health insurance plans Maryland side by side. You’ll see prices, coverage details, and benefits clearly, without confusing tricks.

One big reason people use Maryland Health Connection is affordability. This is the only place where you can check if you qualify for affordable health insurance Maryland through financial help. Many Maryland residents are surprised to learn they can get health insurance subsidies Maryland or a premium tax credit Maryland that lowers their monthly cost. For some families, this can mean saving hundreds of dollars every year.

The marketplace also connects people to government programs. If your income is limited, Maryland Health Connection will check whether you qualify for Maryland Medicaid or CHIP Maryland automatically. You don’t need to apply somewhere else. This makes getting low income health insurance Maryland much easier and less stressful.

Using the marketplace is simple. You create an account, answer a few questions about your household and income, and then review your options. The system helps you understand health insurance Maryland cost before you choose a plan. It even shows whether plans are good for individuals or families, helping you find individual health insurance Maryland or family health insurance Maryland that fits your life.

Another great thing? You’re not alone. Free help is available through trained guides and certified agents. They explain how to get health insurance in Maryland step by step, using clear and friendly language.

Types of Health Insurance Plans Available in Maryland

Now that you know about Maryland Health Connection, it’s time to explore the different health insurance plans Maryland offers. Choosing the right plan is like picking the perfect pair of shoes—it needs to fit your life, budget, and health needs. Let’s break it down so it’s simple and easy to understand.

1. Individual Health Insurance Maryland

This type of plan is for one person. If you’re single, a student, or self-employed, this is probably what you need. You pay monthly premiums, and the plan covers doctor visits, prescriptions, and emergencies. Some plans may also help with preventive care like checkups and vaccines. By picking individual health insurance Maryland, you get coverage tailored to you without paying for people you don’t need.

2. Family Health Insurance Maryland

These plans cover multiple people, like spouses, children, or dependents. Family plans can save money because you bundle everyone under one policy. If you’re searching for the best health insurance plans in Maryland for families, this is the type to consider. It ensures your entire family has protection and peace of mind.

3. Employer-Sponsored Health Insurance Maryland

Many jobs in Maryland offer health insurance as a benefit. Employers usually pay a portion of your premium, making it more affordable. These plans can cover individuals or families and often include additional perks like dental or vision coverage. If your job offers this, it’s often the easiest and cheapest way to get covered.

4. Private Health Insurance Maryland

For those who don’t have coverage through work, private health insurance Maryland allows you to choose a plan directly from health insurance providers in Maryland. You can compare prices, benefits, and networks to find the right fit. Private plans offer flexibility but can cost more than employer-sponsored options.

5. Government Programs: Maryland Medicaid & CHIP Maryland

If you meet income requirements, Maryland Medicaid or CHIP Maryland provides low income health insurance Maryland for free or at very low cost. Medicaid covers medical care, prescriptions, and preventive services. CHIP focuses on children, helping families get affordable care without huge bills.

6. Short-Term or Specialty Plans

Some people need coverage for a limited period or specific needs. Short-term health insurance or specialty plans can fill that gap. While these are less common, they can be useful for students, temporary workers, or people between jobs.

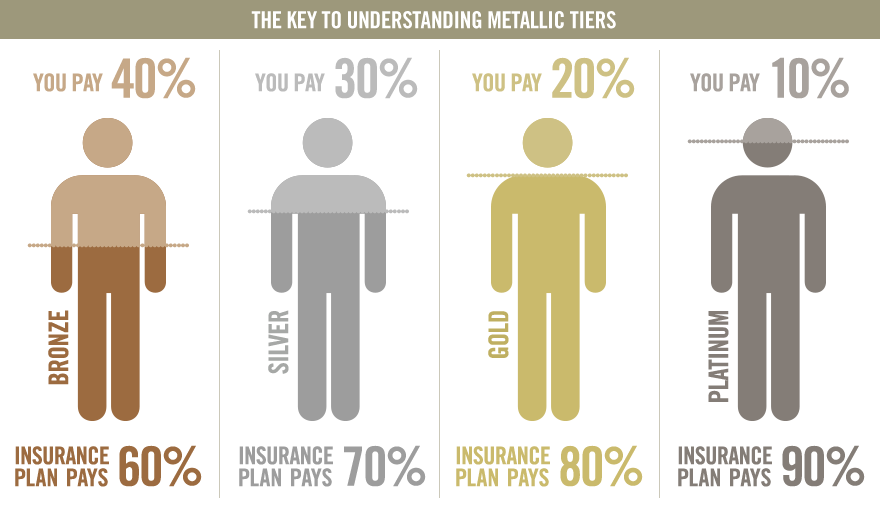

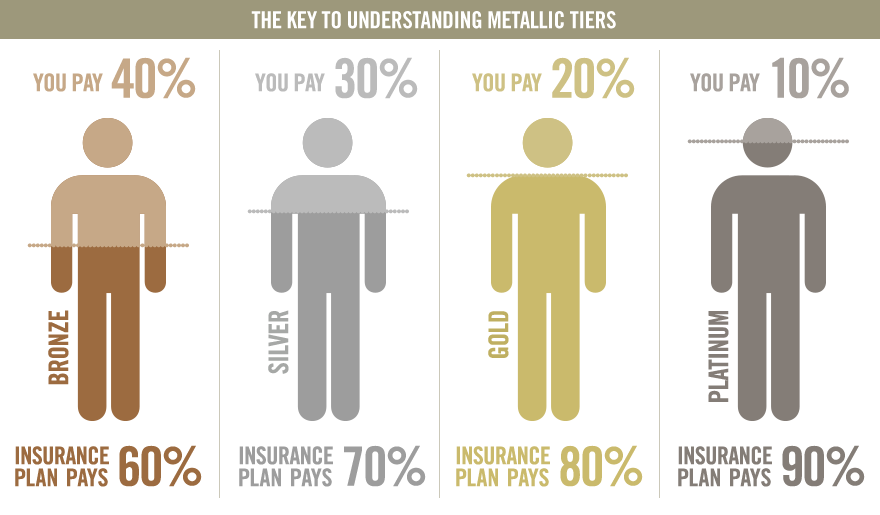

Understanding Plan Categories – Bronze, Silver, Gold, Platinum

Now that you know the types of health insurance plans Maryland, let’s break down the plan categories: Bronze, Silver, Gold, and Platinum. These names might sound fancy, but they are simply a way to show how much a plan pays versus how much you pay out of pocket.

1. Bronze Plans

Bronze plans are great if you want affordable health insurance Maryland with lower monthly premiums. You’ll pay more when you visit the doctor or need care, but the plan covers serious emergencies. This is ideal for generally healthy people who don’t expect frequent doctor visits but want protection against big medical bills.

2. Silver Plans

Silver plans balance cost and coverage. Your monthly premium is moderate, and the plan shares more of the cost when you need care. Many people choose Silver plans because they often qualify for health insurance subsidies Maryland or premium tax credit Maryland, lowering the monthly price even further.

3. Gold Plans

Gold plans cost more each month, but you pay less when you see doctors or get medicine. These are good for people who visit the doctor regularly or have ongoing prescriptions. Families often look at family health insurance Maryland in the Gold category to make predictable costs easier to manage.

4. Platinum Plans

Platinum plans are for those who want the highest coverage and are willing to pay a higher monthly premium. You’ll have minimal out-of-pocket costs when you need care. This plan is excellent for people with frequent medical needs or those who prefer peace of mind.

Why Categories Matter

Choosing the right category affects your budget and access to care. Understanding the differences helps you pick the best health insurance Maryland plan that fits your lifestyle. Remember, it’s not just about price—it’s about the protection and comfort it gives you and your family.

Health Insurance Costs in Maryland

One of the first questions most people ask is, “How much will health insurance Maryland actually cost me?” The truth is, the cost depends on several factors, and understanding them can help you pick the best health insurance Maryland plan without surprises.

1. Monthly Premiums

This is the amount you pay every month for your plan. Affordable health insurance Maryland can start as low as a few hundred dollars per month for individuals and a bit more for families. Employer-sponsored plans often reduce your monthly premium because your employer pays part of the cost.

2. Deductibles

A deductible is the amount you pay out-of-pocket before your insurance starts to cover medical expenses. Bronze plans usually have higher deductibles, meaning you pay more upfront when visiting the doctor, while Platinum plans have lower deductibles.

3. Copays and Coinsurance

Copays are fixed fees you pay for services, like $25 for a doctor visit. Coinsurance is a percentage of the cost you pay after meeting your deductible. For example, a Silver plan might have 20% coinsurance, meaning you pay 20% of the bill, and your insurance covers the rest.

4. Family vs Individual Costs

Individual health insurance Maryland is cheaper than family health insurance Maryland, but family plans provide coverage for everyone in the household. Families with children often benefit from subsidies that make coverage more affordable.

5. Factors Affecting Cost

Several things can change your price, including:

- Age: Older adults often pay more

- Location: Urban areas vs rural Maryland

- Income: Determines eligibility for health insurance subsidies Maryland

- Plan Type: HMO vs PPO, Bronze vs Gold

6. Financial Assistance

If you qualify, Maryland Health Connection can help reduce costs through premium tax credit Maryland or low income health insurance Maryland programs. Many Maryland residents are surprised at how much these programs lower their monthly expenses.

Why It Matters

Knowing Maryland health insurance cost helps you budget and ensures you pick a plan that fits your life. It’s not just about paying monthly; it’s about peace of mind, protection, and avoiding huge unexpected bills.

Financial Assistance & Subsidies in Maryland

Paying for health insurance Maryland can feel overwhelming, but the good news is that many residents qualify for financial help. These programs are designed to make affordable health insurance Maryland possible for everyone, whether you’re single, supporting a family, or between jobs.

1. Premium Tax Credits

Premium tax credits help lower your monthly payments. The amount depends on your income and household size. For example, if you qualify, you might pay significantly less each month for your individual health insurance Maryland or family health insurance Maryland plan. This is one of the easiest ways to save money while still getting comprehensive coverage.

2. Cost-Sharing Reductions

Cost-sharing reductions lower the amount you pay for services like doctor visits, prescriptions, and hospital stays. Many Silver plans qualify for these reductions. This means even if your deductible is high, you won’t face sky-high bills when you need care.

3. Maryland Medicaid

Maryland Medicaid provides low income health insurance Maryland for people who meet income requirements. Coverage includes doctor visits, emergency care, prescription drugs, and preventive services. Families, children, and some adults can get almost free coverage through Medicaid, making it a vital option for many residents.

4. CHIP Maryland

The Children’s Health Insurance Program, or CHIP Maryland, ensures that children from low-income families receive medical care. Even if parents don’t qualify for Medicaid, children can still have coverage, which is essential for school, sports, and regular checkups.

5. Who Qualifies?

Eligibility depends on income, household size, and age. Maryland Health Connection makes it easy to see which programs you qualify for when you apply. It also shows how much you could save with health insurance subsidies Maryland and premium tax credit Maryland, so you can make a smart choice.

6. Why This Matters

Financial assistance ensures that health insurance Maryland isn’t just for people with high incomes. It makes care affordable, protects families from unexpected medical costs, and helps individuals stay healthy without breaking the bank.

Enrollment Periods You Must Know

Knowing when to enroll in health insurance Maryland is just as important as picking the right plan. If you miss the right enrollment period, you could be left without coverage or have to wait months before you can sign up. Let’s make it simple and easy to follow.

1. Open Enrollment

Open enrollment is the official period when anyone can sign up for health insurance plans Maryland. For most people, it happens once a year, usually in the fall. During this time, you can:

- Apply for individual health insurance Maryland

- Switch plans if your current coverage isn’t meeting your needs

- See if you qualify for health insurance subsidies Maryland or a premium tax credit Maryland

Think of open enrollment like the “holiday sale” for health insurance—you don’t want to miss it!

2. Special Enrollment Periods (SEP)

Sometimes life throws a curveball, like a new job, moving, or having a baby. That’s when you can sign up during a special enrollment period. Here are common triggers:

- Losing other coverage

- Marriage or divorce

- Birth or adoption of a child

- Moving to Maryland from another state

During SEP, you can still get affordable health insurance Maryland without waiting for the next open enrollment.

3. Why Timing Matters

Missing enrollment could leave you without coverage for months. Emergency medical bills can be costly, and even minor health issues can add up. With Maryland Health Connection, you’ll be reminded of important deadlines, helping you stay protected.

4. Tips for Smooth Enrollment

- Gather important documents (proof of income, ID, Social Security numbers)

- Review your current Maryland health coverage to see if it meets your needs

- Compare plans to find the best health insurance Maryland for you or your family

- Don’t wait until the last day—early applications reduce stress

Step-by-Step – How to Get Health Insurance in Maryland

Getting health insurance Maryland doesn’t have to be confusing. Follow this simple, step-by-step guide, and you’ll find the best health insurance Maryland plan for you or your family without stress.

Step 1: Check Your Eligibility

Before anything else, see if you qualify for:

- Maryland Medicaid

- CHIP Maryland

- Health insurance subsidies Maryland or premium tax credit Maryland

Maryland Health Connection can quickly show which programs apply to your household and income.

Step 2: Gather Your Documents

To make enrollment smooth, have these ready:

- Social Security numbers

- Proof of income (pay stubs, tax returns)

- Current insurance information (if you have any)

- Personal details for family members (birth dates, names)

Having everything on hand speeds up the process and avoids mistakes.

Step 3: Compare Plans

Look at health insurance plans Maryland side by side. Focus on:

- Monthly premium vs out-of-pocket costs

- Network coverage (HMO or PPO)

- Prescription and preventive care coverage

- Options for individual health insurance Maryland or family health insurance Maryland

Remember, the cheapest plan isn’t always the best. Think about your health needs and budget.

Step 4: Apply Through Maryland Health Connection

Create an account and fill out the application. The system guides you through every question, including:

- Household size

- Income

- Current coverage

Once submitted, it shows the plans you qualify for and the financial help available.

Step 5: Choose Your Plan

Pick the plan that fits your life and budget. Make sure it covers your doctors, medications, and any upcoming medical needs. Check the details carefully—you’re protecting your health and finances.

Step 6: Make Your First Payment

Your insurance isn’t active until your first premium is paid. This could be through a monthly payment, employer contribution, or financial assistance. Don’t skip this step.

Step 7: Keep Your Documents and Confirmation

After enrolling, save:

- Your plan confirmation

- ID cards

- Any correspondence from Maryland Health Connection

This ensures you can use your Maryland health coverage smoothly when needed.

How to Compare Health Insurance Plans in Maryland

Choosing the right health insurance Maryland plan is more than picking the cheapest option. Comparing plans carefully ensures you get the coverage you need at a price you can afford. Let’s make it simple.

1. Look at Premiums vs Out-of-Pocket Costs

- Monthly Premium: The amount you pay every month

- Deductibles, Copays, Coinsurance: What you pay when you visit a doctor or hospital

Sometimes a plan with a higher premium saves money in the long run because it has lower deductibles and copays. Think about your medical habits and choose wisely.

2. Check Network Coverage

- HMO vs PPO: HMOs have smaller networks but lower costs, PPOs offer more flexibility

- Make sure your preferred doctors and hospitals are included

- This is especially important for family health insurance Maryland, where everyone may have different doctors

3. Compare Prescription Coverage

- Look at your current medications

- Ensure the plan covers your prescriptions

- Some plans charge extra for specialty medicines

4. Consider Plan Categories

- Bronze, Silver, Gold, Platinum: each has different cost and coverage balance

- Match the category to your health needs and budget

- For example, frequent doctor visits may benefit from Gold or Platinum plans

5. Review Extra Benefits

- Preventive care (vaccines, screenings)

- Mental health support

- Emergency services coverage

Plans with more benefits might cost a bit more but can save money and stress later.

6. Check for Financial Assistance

- Health insurance subsidies Maryland

- Premium tax credit Maryland

- Some plans may lower your monthly costs significantly if you qualify

7. Read Reviews and Ratings

- Some health insurance providers in Maryland have better customer service or easier claim processes

- Reading experiences from other Maryland residents can help you pick a plan you’ll be happy with

Maryland Health Insurance Laws & Consumer Protections

When it comes to health insurance Maryland, knowing your rights is just as important as choosing the right plan. Maryland has laws and protections in place to make sure you get the coverage you pay for and avoid surprises.

1. Guaranteed Issue

Maryland law requires that all insurance companies provide coverage to anyone, regardless of health conditions. This means you cannot be denied health insurance Maryland because of pre-existing conditions.

2. Essential Health Benefits

All plans in Maryland must cover certain essential services, including:

- Doctor visits and hospital care

- Emergency services

- Prescription drugs

- Preventive care like vaccinations and screenings

These protections ensure that your Maryland health coverage gives you real value, not just a piece of paper.

3. Limits on Out-of-Pocket Costs

Maryland law sets limits on how much you can be asked to pay out of pocket each year. This includes deductibles, copays, and coinsurance. Knowing these limits helps you plan your budget and reduces financial stress.

4. Consumer Assistance

The Maryland Insurance Administration offers help for questions, complaints, and disputes. They can guide you if:

- Your claim is denied

- You are overcharged

- You need help understanding plan rules

This makes Maryland health insurance plans safer and easier to navigate.

5. Protections for Children and Families

Programs like CHIP Maryland ensure children from low-income families get coverage. Laws protect families from losing coverage suddenly, even if circumstances change, like a parent’s job or income.

6. Transparency Requirements

Insurance providers must clearly show:

- Plan costs

- Covered services

- Network restrictions

This transparency makes it easier to compare health insurance plans Maryland and choose the best health insurance Maryland option for your needs.

Common Mistakes Maryland Residents Make When Buying Insurance

Even with all the information available, many people still make mistakes when selecting health insurance Maryland. Avoiding these errors can save you money, stress, and headaches.

1. Choosing the Cheapest Plan

It’s tempting to pick the plan with the lowest monthly premium, but that doesn’t always mean it’s the best. Sometimes low-cost plans have high deductibles or limited coverage. Always compare health insurance plans Maryland based on both cost and benefits.

2. Ignoring Provider Networks

If your preferred doctor or hospital isn’t in the plan’s network, you may end up paying a lot more. Check the network carefully, especially for family health insurance Maryland, where everyone may have different doctors.

3. Forgetting About Prescription Coverage

Many plans don’t fully cover medications or have high co-pays for certain drugs. Make sure the plan covers your current prescriptions and any potential future medications.

4. Missing Enrollment Deadlines

Not enrolling during open enrollment or failing to use a special enrollment period can leave you without coverage. Always track dates for Maryland Health Connection enrollment periods.

5. Not Considering Life Changes

Life events like a new job, marriage, moving, or having a child can affect your coverage. Not updating your plan can lead to gaps in protection. Remember, special enrollment periods exist for these situations.

6. Overlooking Financial Assistance

Many Maryland residents qualify for health insurance subsidies Maryland or premium tax credit Maryland but don’t apply. Ignoring these programs means paying more than necessary.

7. Failing to Read the Fine Print

Every plan has rules about coverage, exclusions, and out-of-pocket costs. Skipping this step can result in unexpected bills or denied claims. Take time to review the details before choosing your best health insurance Maryland option.

FAQs – Health Insurance in Maryland

Even after reading all this, you might still have questions. Here are the most common ones about health insurance Maryland, answered clearly and simply.

1. Is health insurance mandatory in Maryland?

Yes, while the federal penalty for not having insurance no longer applies, having Maryland health coverage is highly recommended to avoid high medical bills in emergencies.

2. Can I get health insurance without a job?

Absolutely! You can apply for individual health insurance Maryland or use Maryland Health Connection. You may also qualify for Maryland Medicaid or CHIP Maryland if your income is low.

3. What if my income changes during the year?

Income changes can affect your eligibility for health insurance subsidies Maryland or premium tax credit Maryland. Report changes promptly through Maryland Health Connection to adjust your plan.

4. Can I change plans anytime?

Typically, you can only change plans during open enrollment. However, qualifying life events like marriage, moving, or having a child allow you to use a special enrollment period to switch plans.

5. What are the cheapest health insurance options in Maryland?

The cheapest options are usually Bronze plans or plans eligible for health insurance subsidies Maryland. However, it’s important to balance cost with coverage to avoid unexpected expenses.

6. Does Medicaid cover families in Maryland?

Yes. Maryland Medicaid provides low income health insurance Maryland for families, children, and certain adults. Children may also be covered under CHIP Maryland.

7. How do I know which plan is the best for me?

Look at premiums, deductibles, network coverage, prescription coverage, and any family needs. Comparing health insurance plans Maryland side by side on Maryland Health Connection helps you pick the best health insurance Maryland for your situation.

8. Where can I get help with enrollment?

You can get free guidance from certified agents, navigators, and the Maryland Health Connection help center. They can walk you through the process step by step and answer any questions.

Final Thoughts & Next Steps

Congratulations! By now, you have a solid understanding of health insurance Maryland and all the options available to you. Health insurance isn’t just paperwork—it’s protection, peace of mind, and a way to take care of yourself and your loved ones. Whether you’re looking for individual health insurance Maryland, family health insurance Maryland, or affordable health insurance Maryland, the key is making an informed choice.

Recap of Key Points

- Maryland offers multiple health insurance plans Maryland, including employer-sponsored, private, and government programs like Maryland Medicaid and CHIP Maryland.

- Maryland Health Connection is your go-to marketplace for comparing plans and checking eligibility for health insurance subsidies Maryland or a premium tax credit Maryland.

- Plan categories—Bronze, Silver, Gold, and Platinum—affect costs and coverage, so choose what fits your lifestyle.

- Avoid common mistakes like picking only the cheapest plan, ignoring networks, or missing enrollment deadlines.

Next Steps to Take

- Check your eligibility for Medicaid, CHIP, or financial assistance.

- Gather documents like income proof, Social Security numbers, and personal info for all family members.

- Compare plans on Maryland Health Connection to see what fits your budget and needs.

- Enroll during the right period—open enrollment or a special enrollment period.

- Keep records of your plan confirmation and ID cards for smooth use.