Discover the best student health insurance for international students in the USA. Learn about F-1 & J-1 visa coverage, university vs private plans, costs, benefits, and tips to find affordable international student health insurance for you and your dependents.

Introduction to Student Health Insurance for International Students in the USA

Moving to a new country to study is exciting—but it can also be a little overwhelming. One thing every international student in the USA needs to think about right away is student health insurance for international students. It’s not just a requirement—it’s your safety net, your peace of mind, and your ticket to worry-free studying.

Why is health insurance so important? Imagine you get sick or need medical care while studying abroad. Without proper international student health insurance USA, even a minor visit to the doctor could cost hundreds—or even thousands—of dollars. That’s where F-1 student health insurance or J-1 student health insurance comes in. It covers essential things like doctor visits, hospitalization, prescriptions, emergency care, and sometimes even mental health support. In other words, it keeps you safe and financially protected while you focus on your studies.

Universities in the USA often require that all international students carry health insurance. Some schools offer university health insurance plans USA, while others allow students to choose private providers. Either way, meeting these requirements is crucial for your F-1 or J-1 visa compliance. Skipping it isn’t just risky for your health—it can affect your visa status too.

Now, you might be thinking, “There are so many options! How do I choose?” Don’t worry—this guide is here to make it simple. We’ll explain everything from the best student health insurance for international students in the USA, to how to find affordable student health insurance USA, and even tips for dependents or short-term coverage. You’ll also learn how to enroll, understand costs like premiums and deductibles, and compare university vs private insurance plans.

By the end of this article, you’ll know exactly how to get the US university international student health insurance requirements covered without stress. You’ll feel confident choosing a plan that fits your needs, your budget, and keeps you fully protected.

So, let’s dive in and explore everything you need to know about international student health insurance for dependents USA, how it works, why it’s mandatory, and how to pick the right coverage for a worry-free student life in the USA.

What is Student Health Insurance?

When you hear the term student health insurance for international students, you might wonder, “Is this really necessary?” The short answer is yes! Let’s break it down.

Student health insurance is a special type of insurance designed specifically for students studying abroad. For international students in the USA, having international student health insurance USA isn’t just a good idea—it’s often required by universities and even your F-1 or J-1 visa rules.

So, what does it cover? Most plans include doctor visits, hospital care, prescriptions, emergency services, and sometimes mental health support. Some even provide dental and vision coverage if you choose extra add-ons. Basically, it’s your financial safety net while living in a new country. Imagine facing a medical emergency in the USA without coverage—it could be incredibly stressful and expensive. That’s why US international student insurance is essential.

There are a few types of plans to know about:

- University-provided insurance plans: Many US universities offer their own plans to meet visa and campus requirements. These are called university health insurance plans USA and often include automatic enrollment.

- Private insurance providers: If your school allows it, you can choose a plan from private companies. This can sometimes be cheaper or offer more flexibility.

- Short-term or summer coverage: For students arriving early or staying over breaks, short-term plans ensure you’re covered without paying full-year premiums.

Another important thing: not all plans are equal. Affordable student health insurance USA doesn’t just mean low cost. It also means good coverage, reliable providers, and peace of mind. Comparing university plans versus private options helps you find the best student health insurance for international students in the USA.

In simple words, think of student health insurance as your safety shield in the USA. It keeps you protected, ensures you can see doctors when needed, and helps you avoid high medical bills. By understanding your options and coverage, you can focus on what matters most—your studies, friends, and new experiences.

With this foundation, you’ll be ready to explore mandatory health insurance for international students USA, compare costs, and choose a plan that fits your life perfectly.

Who Needs Health Insurance?

If you’re an international student in the USA, one question you might have is: “Do I really need student health insurance for international students?” The answer is simple: yes, almost everyone does. Let’s break it down.

1. F-1 and J-1 Visa Holders

If you’re studying in the USA on an F-1 or J-1 visa, universities usually require you to have F-1 student health insurance or J-1 student health insurance. These plans ensure you’re covered from the moment you arrive on campus. Without it, you could face fines, limited access to healthcare, or even problems with your visa compliance.

2. Dependents (F-2 and J-2 Visa Holders)

Many students bring family members along. Your spouse or children (F-2/J-2) may also need coverage. This is where international student health insurance for dependents USA comes in. Plans for dependents often cover doctor visits, prescriptions, hospital stays, and sometimes emergency services. Even if your dependents are healthy, having coverage can prevent huge unexpected bills.

3. Exchange and Short-Term Students

Even if you’re only in the USA for a semester or summer program, short-term student health insurance USA is important. It protects you from sudden illnesses or accidents while studying abroad. Many universities allow short-term plans specifically for these students.

4. Optional vs Mandatory

Some schools automatically enroll students in university health insurance plans USA, while others let you choose. If you already have a private plan, you may be eligible for a health insurance waiver for international students USA—but it must meet university and visa requirements.

Why Everyone Needs Coverage

Without proper US international student insurance, even a simple emergency could cost thousands. Hospital bills, ambulance rides, or prescriptions can be very expensive in the USA. Having student insurance plans USA keeps you safe, financially secure, and focused on your studies rather than worrying about medical costs.

Summary

Whether you’re an F-1 or J-1 student, bringing dependents, or staying short-term, student health insurance for international students is essential. Understanding who needs it ensures you stay compliant, protected, and stress-free during your studies in the USA.

Mandatory Health Insurance Requirements in the USA

If you’re planning to study in the USA, one of the first things you need to understand is mandatory health insurance for international students USA. Most universities require it, and your visa might too. Let’s break it down in simple terms.

1. University Requirements

Almost every US university has rules for student health insurance for international students. Some automatically enroll students in university health insurance plans USA, while others let you choose a private plan that meets their standards. These requirements exist to make sure all students can access medical care when they need it.

2. Visa Requirements

Your F-1 or J-1 visa also plays a role. The U.S. government wants to make sure international students are protected while studying. That’s why having F-1 student health insurance or J-1 student health insurance is often mandatory. Without coverage, you might run into problems with visa compliance, which can be stressful and costly.

3. Coverage Minimums

Universities and the government usually have minimum coverage requirements. Plans must include:

- Doctor visits and hospital stays

- Emergency care and evacuation

- Prescription medications

- Some schools require mental health and preventive care

Meeting these requirements ensures your US international student insurance is valid, whether it’s through a university plan or a private provider.

4. Waivers

If you already have a plan from home, you might qualify for a health insurance waiver for international students USA. However, your plan must meet university and visa standards. Many students overlook this step, but applying for a waiver can save money if your existing plan is sufficient.

5. Importance of Compliance

Not following the rules isn’t just risky for your health—it can affect your studies and visa status. Imagine getting sick and not having coverage, or facing a penalty for not meeting university insurance requirements. Staying compliant keeps you safe, healthy, and stress-free while studying abroad.

Summary

Understanding mandatory health insurance for international students USA is crucial. Whether it’s a university plan or a private plan, meeting these requirements ensures you have access to care, comply with your visa, and enjoy your student life in the USA without unnecessary worries.

Types of Plans for International Students

When it comes to student health insurance for international students, there are several types of plans to choose from. Knowing your options helps you pick the right coverage for your needs, budget, and visa requirements.

1. University-Provided Insurance Plans

Many US universities automatically enroll students in university health insurance plans USA. These plans are designed to meet both the school’s requirements and your F-1 or J-1 visa needs. Benefits often include:

- Doctor visits and hospital care

- Prescription coverage

- Emergency services

- Some even include mental health support

University plans are convenient because they’re easy to enroll in and ensure you comply with university and visa rules.

2. Private Insurance Providers

If your university allows, you can choose a plan from private companies. Private health insurance for international students USA often offers:

- Flexible coverage options

- Potentially lower costs

- Extended networks of doctors and hospitals

Comparing student insurance plans USA from private providers can sometimes help you find affordable student health insurance USA that fits your lifestyle.

3. Short-Term or Summer Coverage

Some students come to the USA for a single semester, summer program, or exchange. For these students, short-term student health insurance USA is ideal. These plans provide coverage for a limited period without paying for a full academic year, making them budget-friendly and convenient.

4. Coverage for Dependents

Bringing your family along? Dependents (spouse or children) also need coverage. International student health insurance for dependents USA ensures your loved ones have access to medical care, prescriptions, and emergencies while staying in the USA. Including dependents in your plan keeps your whole family protected and stress-free.

Summary

Choosing the right plan depends on your situation. Whether it’s a university-provided plan, a private provider, short-term coverage, or dependent insurance, knowing your options helps you pick the best student health insurance for international students in the USA. This ensures peace of mind, compliance with university and visa rules, and protection for both you and your loved ones while studying abroad.

Coverage Details You Must Know

When choosing student health insurance for international students, it’s not enough to just pick a plan. You need to understand what it actually covers. Knowing the details ensures you won’t be surprised by bills when you need care most.

1. Doctor Visits and Hospital Care

Most US international student insurance plans cover routine doctor visits, urgent care, and hospitalization. This means if you catch a cold, get sick, or need surgery, your plan helps you pay for it. Some university plans even cover mental health services, which is often overlooked but important for international students adjusting to life in the USA.

2. Emergency Services

Accidents and emergencies can happen anytime. F-1 student health insurance and J-1 student health insurance usually cover ambulance rides, emergency room visits, and critical care. Emergency coverage is especially important if you’re studying far from home or in a new city.

3. Prescription Medications

Prescription drugs can be expensive in the USA. Most international student health insurance USA plans cover necessary medications, reducing your out-of-pocket costs. Always check whether your plan covers the specific medications you need.

4. Optional Add-Ons

Some plans allow you to add extras like dental, vision, or travel evacuation coverage. If you plan to travel outside the USA or want extra protection for your eyes and teeth, these add-ons are worth considering. They make your student insurance plans USA more comprehensive.

5. What’s Not Covered

It’s also important to know the limits. Cosmetic procedures, elective surgeries, or treatments not approved by the plan may not be covered. Checking this ahead of time can save money and stress later.

Summary

Understanding student health insurance coverage USA helps you choose wisely. From doctor visits and emergency care to prescriptions and optional add-ons, knowing your plan ensures you get the protection you need. Whether you choose a university health insurance plan USA or a private provider, these coverage details keep you safe, compliant, and worry-free while studying abroad.

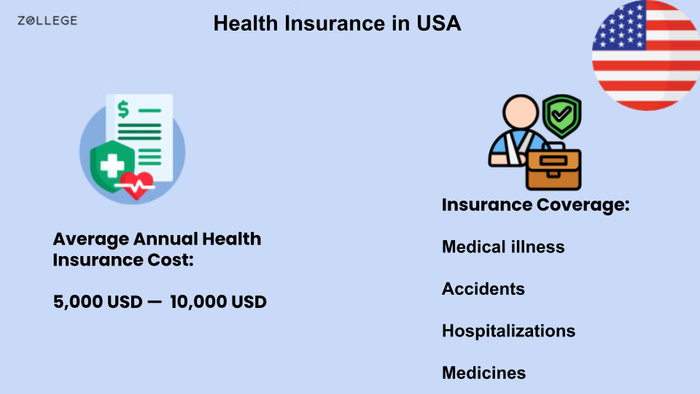

How Much Does Student Health Insurance Cost in the USA?

One of the biggest questions international students have is about money: “How much will student health insurance for international students cost?” Let’s break it down so it’s easy to understand.

1. Average Premiums

The cost of international student health insurance USA varies depending on the plan and university. On average, students pay anywhere from $500 to $2,000 per year. University plans tend to be slightly higher but cover most essentials. Private plans might be cheaper but require careful comparison.

2. Deductibles and Copays

Premiums aren’t the only cost. Most student insurance plans USA include deductibles—the amount you pay before insurance kicks in—and copays for doctor visits. For example:

- Deductible: $200–$500

- Doctor visit copay: $20–$40

Understanding these numbers helps you budget for unexpected medical costs.

3. Out-of-Pocket Maximums

Out-of-pocket maximums cap how much you pay in a year. Once reached, your insurance covers 100% of eligible expenses. Most F-1 student health insurance and J-1 student health insurance plans include this, giving peace of mind in case of major illnesses or accidents.

4. Cost Differences Between University and Private Plans

- University plans: Often higher cost but automatically meet visa and university requirements.

- Private plans: Can be cheaper and offer flexibility, but make sure they satisfy US university international student health insurance requirements.

5. Tips to Save Money

- Look for affordable student health insurance USA plans without compromising coverage.

- Compare providers and coverage details.

- Consider short-term or summer coverage if you’re staying less than a full year.

- Check if your existing plan qualifies for a health insurance waiver for international students USA.

Summary

Understanding how much international student health insurance USA costs helps you plan your budget. By knowing premiums, deductibles, copays, and out-of-pocket maximums, you can confidently choose the best student health insurance for international students in the USA without surprises. Cost-conscious decisions ensure you stay safe, healthy, and financially secure while studying abroad.

Tips to Find Affordable Health Insurance

Finding the best student health insurance for international students in the USA doesn’t have to be complicated. With the right approach, you can get affordable student health insurance USA without sacrificing coverage. Here’s how.

1. Compare University and Private Plans

Many students automatically get university health insurance plans USA, but these aren’t always the cheapest. Look at private health insurance for international students USA as well. Compare costs, coverage, and benefits to see which plan suits your needs and budget.

2. Check Coverage Details

Don’t just focus on price. Look closely at what each plan covers. A cheaper plan might not include emergency services, prescriptions, or mental health support, which are crucial for international students. Make sure your plan meets US university international student health insurance requirements.

3. Consider Short-Term or Seasonal Plans

If you’re in the USA for less than a year, short-term plans can save money. These plans provide essential coverage for a semester or summer, giving you peace of mind without paying full-year premiums.

4. Explore Dependent Coverage

If you’re bringing family members, look for international student health insurance for dependents USA. Bundling your dependents can sometimes reduce costs and ensures everyone is protected.

5. Look for Waivers

Some students already have a plan from home. If your existing plan meets university and visa standards, you might qualify for a health insurance waiver for international students USA. Always check the rules—this can save you money while staying compliant.

6. Use Online Resources and Reviews

Read reviews and ask for recommendations from other international students. Checking provider ratings helps you find reliable student insurance plans USA and avoid surprises.

Summary

Finding affordable student health insurance USA is all about comparing options, checking coverage, considering dependents, and exploring waivers. By following these tips, you can choose a plan that keeps you safe, compliant, and financially secure while studying abroad. With the right plan, you can focus on your studies and enjoy your experience in the USA without worrying about medical bills.