Discover how a contributory health service scheme helps employees and employers share healthcare costs efficiently. Learn about defined contribution health plans, employer health benefits contributions, HRAs (ICHRA & QSEHRA), and how to choose the right plan for your team.

Understanding the Contributory Health Service Scheme

Have you ever wondered how people pay for medical care when hospital bills can cost a fortune? That’s where a contributory health service scheme comes in — a smart way to make healthcare easier, fairer, and less stressful for everyone.

In simple words, a contributory health service scheme is a plan where both you and your employer (sometimes even the government) share the cost of health insurance. Think of it like a team effort: instead of one person paying the full amount, everyone contributes a little to create a big pool of money. That pool then covers medical bills when someone gets sick. Pretty clever, right?

In the United States, this idea is often called a defined contribution health plan or employer contribution health insurance. Under this model, an employer decides how much money they’ll chip in every month — say $400 per employee — to help cover healthcare costs. You can then use that contribution to buy your own plan through a marketplace or choose from your company’s employer-sponsored health insurance options.

One of the best things about these plans is flexibility. You can pick a health plan that fits your needs and budget. Some people prefer more coverage for peace of mind; others choose lower premiums to save money each month. With an employer health benefits contribution, the choice is yours.

There are also special programs like Individual Coverage HRA (ICHRA) and Qualified Small Employer HRA (QSEHRA). These allow employers — especially small businesses — to give workers tax-free funds to pay for health reimbursement arrangements (HRA) or personal insurance policies. It’s like getting a gift card that’s only for doctor visits and prescriptions.

This employer-sponsored insurance model doesn’t just help individuals. It also gives employers cost predictability — they can control their spending instead of facing surprise premium hikes. At the same time, employees enjoy access to affordable healthcare without worrying about huge bills.

In short, the contributory health insurance plan is all about shared responsibility, smart planning, and financial peace of mind. It brings together the best of both worlds: employer support and individual freedom. Whether you work for a big company or a small business, this kind of contributory health service scheme could be your ticket to better, stress-free healthcare.

How the Contributory Health Service Scheme Works in the U.S.

So, how does this contributory health service scheme actually work in the United States? Let’s break it down step by step — no boring jargon, just simple, real-life examples.

Imagine you work for a company that offers employer-sponsored health insurance. Every month, both you and your employer contribute a set amount toward your health coverage. For example, your company might pay 70% of your health insurance premium, and you pay the remaining 30%. That shared effort is what makes it a contributory health insurance plan — everyone chips in so nobody bears the full weight.

Your employer decides the contribution amount, and that can come in a few different ways. Some companies use defined contribution health plans, which means they give you a fixed sum of money — let’s say $400 each month — to buy your own insurance. Others might offer a more traditional group plan where the employer and employee split the cost of premiums.

To make things even better, there are new, flexible models like Individual Coverage HRA (ICHRA) and Qualified Small Employer HRA (QSEHRA). These programs allow companies, especially small businesses, to reimburse employees for their personal health insurance premiums or other medical expenses on a tax-free basis. That’s a win-win: employers save on taxes, and employees get to pick the plan that suits their lifestyle best.

Here’s the magic part — health reimbursement arrangements (HRA) don’t just give you more freedom; they also make healthcare simpler. You can visit your favorite doctor, choose your own insurance provider, and still enjoy the support of your employer’s health benefits contribution.

In the bigger picture, this employer contribution health insurance model encourages shared responsibility, financial security, and personal choice. It helps businesses keep talented employees happy and healthy while giving workers control over their healthcare decisions.

So, whether you’re running a company or working for one, understanding how the contributory health service scheme works can help you make smarter, more confident choices about your health coverage. It’s not just about paying bills — it’s about creating a system that truly cares for everyone involved.

Benefits of a Contributory Health Service Scheme for Employers and Employees

Let’s be honest — everyone loves perks, especially when it comes to health. That’s exactly why a contributory health service scheme is a game-changer for both employers and employees. It’s not just about paying for medical bills; it’s about financial peace of mind, flexibility, and making life easier.

Benefits for Employees

First, let’s talk about you — the employee. One of the biggest advantages of a contributory health insurance plan is that it makes healthcare more affordable. Instead of paying the full premium alone, the employer health benefits contribution covers a big portion, reducing your monthly expenses. That means fewer stressful bills and more money in your pocket for other things — like Netflix, groceries, or that long-awaited vacation.

Another perk? Choice and flexibility. With models like Individual Coverage HRA (ICHRA) or Qualified Small Employer HRA (QSEHRA), you can pick a plan that fits your lifestyle. Want a plan with a lower deductible but higher premium? Or one with more coverage for prescriptions? It’s up to you! Thanks to the defined contribution health plan approach, employees have the freedom to customize their coverage while still benefiting from the company’s support.

Benefits for Employers

Now, let’s flip the coin. Employers aren’t left out — they get some serious wins too. A contributory health service scheme helps businesses predict costs and manage budgets more effectively. Instead of facing unpredictable premium hikes, employers set a fixed contribution amount for all employees. That makes financial planning much simpler.

Plus, offering a health benefits contribution boosts employee satisfaction. Happy employees are productive employees, and retention rates go up. It’s also a way for companies to stand out in a competitive job market — showing that they care about their team’s health and wellbeing.

Shared Advantages

The magic happens when both sides benefit. Employees enjoy affordable, flexible coverage, and employers get budget predictability and employee loyalty. It’s like teamwork in action: everyone contributes a little, and the result is a healthier, happier, and more secure workforce.

In short, the contributory health service scheme isn’t just a fancy term — it’s a practical, effective, and fair way to make health insurance work for everyone. Whether you’re an employer or an employee, embracing this model can save money, reduce stress, and even improve overall wellbeing.

Challenges and Limitations of Contributory Health Service Schemes

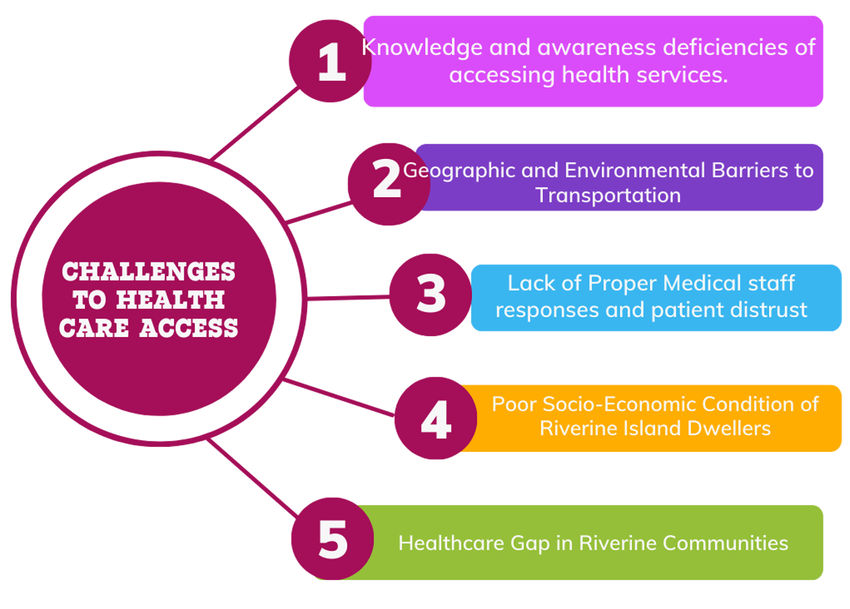

While a contributory health service scheme sounds like a dream, it’s not without its hurdles. Just like anything worth having, there are some challenges to keep in mind — both for employees and employers.

1. Employee Confusion

One of the biggest issues is that employees sometimes don’t fully understand how their contributory health insurance plan works. With choices like Individual Coverage HRA (ICHRA) or Qualified Small Employer HRA (QSEHRA), it can feel overwhelming to pick the right plan. Some employees may worry about making the “wrong” choice or missing out on coverage. Clear communication is key — companies need to explain how the employer health benefits contribution works in simple terms.

2. Cost Inequity

Another challenge is fairness. Not every employee may benefit equally from a defined contribution health plan. For instance, high-cost medical needs or family coverage can make the fixed contribution feel less helpful for some people. This is especially true if the employer contribution health insurance is the same for everyone, regardless of family size or health requirements.

3. Administrative Complexity

Employers, especially small businesses, may struggle with managing these plans. Offering employer-sponsored health insurance with health reimbursement arrangements (HRA) or QSEHRA programs requires tracking contributions, compliance, and reimbursements. Without proper tools or software, it can quickly become a headache.

4. Compliance and Legal Risks

There’s also the matter of rules. Employers must follow ACA guidelines, IRS rules, and nondiscrimination laws. Mistakes can lead to fines or legal trouble. Using a contributory health service scheme responsibly means understanding these regulations and making sure all employees are treated fairly.

5. Limited Coverage in Some Cases

Sometimes, a contributory health insurance plan may not cover everything an employee needs. For example, certain treatments, specialists, or medications might be excluded, leaving employees to pay out-of-pocket. This can lead to dissatisfaction if expectations aren’t clear from the start.

✅ Wrapping Up

Even with these challenges, the contributory health service scheme remains a smart and flexible way to provide healthcare. Employers and employees can overcome these limitations with good communication, careful planning, and tools to manage contributions.

In short, no system is perfect, but understanding these hurdles helps you make the most of a defined contribution health plan, employer health benefits contribution, or any health reimbursement arrangement. Awareness is the first step toward a smoother, stress-free healthcare experience for everyone.

Regulatory and Legal Framework for Contributory Health Service Schemes in the U.S.

If you’re thinking about joining or offering a contributory health service scheme, it’s important to know the rules. In the U.S., health plans are carefully regulated to make sure both employees and employers are protected.

1. The ACA and Employer Mandates

The Affordable Care Act (ACA) plays a big role here. Employers offering employer-sponsored health insurance must meet minimum coverage standards. That means your contributory health insurance plan has to provide certain essential benefits, and large employers have to offer coverage to full-time employees or face penalties.

2. IRS Guidelines

If your company uses defined contribution health plans, health reimbursement arrangements (HRA), or programs like Individual Coverage HRA (ICHRA) and Qualified Small Employer HRA (QSEHRA), the IRS rules determine how contributions are taxed. For instance:

- Employer contributions are typically tax-free for employees.

- Employees may use these contributions to pay for premiums or medical expenses without owing federal income tax.

Following IRS rules ensures that your employer health benefits contribution stays legal and beneficial for everyone.

3. Nondiscrimination Rules

One tricky area is fairness. Employers must follow nondiscrimination laws to make sure high-paid or select employees don’t get better benefits than others. This is especially important in contributory health insurance plans where contributions are fixed or vary. Companies need to check that every eligible employee has a fair chance to benefit.

4. ERISA and HIPAA Compliance

- ERISA (Employee Retirement Income Security Act) protects employees’ rights in employer-sponsored plans.

- HIPAA (Health Insurance Portability and Accountability Act) ensures your health information is private and secure.

Any contributory health service scheme that involves employer contributions or health reimbursement arrangements must comply with these laws. That’s why smart employers use proper platforms and follow documentation rules carefully.

5. Why Compliance Matters

Understanding the regulatory and legal framework protects both sides:

- Employees know their coverage is secure.

- Employers avoid fines, lawsuits, or penalties.

- Everyone enjoys a transparent, trustworthy contributory health service scheme experience.

In short, following the rules isn’t just about avoiding trouble — it builds confidence, trust, and reliability. After all, a well-regulated employer-sponsored health insurance plan with a clear employer contribution health insurance strategy makes life easier, safer, and less stressful for everyone involved.

Real-World Examples and Case Studies

Sometimes, the best way to understand a contributory health service scheme is to see how it works in real life. Let’s look at a few examples from the U.S. that show how employer-sponsored health insurance and defined contribution health plans are making a difference.

Example 1: Tech Company Embraces ICHRA

A mid-sized tech company decided to switch to an Individual Coverage HRA (ICHRA). Instead of offering a one-size-fits-all group plan, they gave employees a fixed employer health benefits contribution every month — around $450 per employee. Employees could then choose a plan that suited their needs, whether they wanted more coverage for doctor visits or lower premiums.

The result? Employees felt empowered to pick the plan that worked best for them, and the company gained predictable healthcare costs. It’s a classic win-win from a contributory health insurance plan perspective.

Example 2: Small Business Using QSEHRA

A small business with 15 employees decided to adopt a Qualified Small Employer HRA (QSEHRA). Each employee received $300 per month to cover their personal health insurance premiums. The employer avoided administrative headaches of managing a large group plan, while employees enjoyed tax-free reimbursements for their insurance.

This approach not only saved money but also gave employees flexibility and freedom to choose plans they actually wanted. That’s the power of a contributory health service scheme in action.

Example 3: Traditional Employer Contribution Health Plan

A larger company continued with a traditional employer-sponsored insurance model but implemented a defined contribution health plan for part-time workers. Instead of offering full coverage, they provided a fixed health benefits contribution per employee.

Employees who wanted more coverage could top up the amount themselves, while the company maintained budget predictability and compliance with ACA and IRS rules.

Common Misconceptions About Contributory Health Service Schemes

Even though a contributory health service scheme is becoming more popular, there are still some myths floating around. Let’s clear them up so you can understand the truth.

Misconception 1: “Employees Pay Everything”

Some people think a contributory health insurance plan means employees cover the full cost of healthcare. That’s not true! In reality, the employer health benefits contribution covers a significant portion of the premiums. Employees just chip in the rest, making it more affordable and manageable.

Misconception 2: “Only Big Companies Can Offer This”

You might assume that only giant corporations can provide defined contribution health plans. Wrong again! Small businesses can also implement programs like Qualified Small Employer HRA (QSEHRA) or Individual Coverage HRA (ICHRA). These plans allow small employers to provide tax-free contributions to employees without breaking the bank.

Misconception 3: “It Eliminates Employer Responsibility”

Another myth is that if a company offers a contributory health service scheme, they’re off the hook. Not true. Employers still have to follow ACA compliance rules, IRS regulations, and nondiscrimination laws. The difference is that they can provide coverage in a flexible, cost-predictable way while still helping employees access quality healthcare.

Misconception 4: “Employees Don’t Have Choices”

Some believe that a contributory health insurance plan is rigid, and employees must accept whatever the employer provides. In fact, modern plans give employees options and flexibility. With defined contribution health plans or health reimbursement arrangements (HRA), employees can pick a plan that suits their needs — whether it’s lower premiums, specific doctor coverage, or family-friendly benefits.

Misconception 5: “It’s Too Complicated to Manage”

Yes, it can take some planning, but it’s not rocket science. With proper tools and guidance, employer-sponsored health insurance and health benefits contributions can be managed efficiently. Many companies use software platforms to track contributions, reimbursements, and compliance, making the whole contributory health service scheme much simpler than it sounds.

Emerging Trends and Future Outlook for Contributory Health Service Schemes

Healthcare is changing fast, and so is the way we handle contributory health service schemes. If you think this system is static, think again — the future is full of innovation, flexibility, and smarter planning.

Trend 1: Personalized Health Benefits

One big trend is personalized health coverage. Employers are moving toward defined contribution health plans that let employees choose exactly what they need. Want dental coverage but not vision? Need a high deductible plan for lower monthly costs? The employer health benefits contribution can be applied flexibly, giving employees control over their contributory health insurance plan.

Trend 2: Technology and Digital Platforms

Digital tools are making employer-sponsored health insurance easier to manage. Platforms track contributions, reimbursements, and compliance automatically, even for complex plans like Individual Coverage HRA (ICHRA) or Qualified Small Employer HRA (QSEHRA). This means less paperwork, fewer mistakes, and faster approvals — everyone wins.

Trend 3: Cost Control and Predictability

Rising healthcare costs are pushing more companies to adopt contributory health insurance plans. Fixed health benefits contributions help employers predict costs and avoid budget surprises. At the same time, employees enjoy coverage that fits their needs without excessive premiums. It’s a win-win scenario that makes both sides feel secure.

Trend 4: Employee-Centric Approach

Employees today want more say in their benefits. Flexible health reimbursement arrangements (HRA) and defined contribution health plans give them the freedom to choose plans that match their lifestyle. From wellness perks to telehealth options, the focus is on employee satisfaction and wellbeing, not just compliance.

Trend 5: Policy and Regulatory Evolution

As ACA regulations and IRS rules evolve, employers are adapting their contributory health service schemes to stay compliant and competitive. This includes new options for tax-free contributions, portable coverage, and expanded flexibility for small businesses. Staying ahead of policy changes ensures both employers and employees benefit fully.

How to Choose or Design the Right Contributory Health Service Scheme

Choosing the right contributory health service scheme doesn’t have to be scary. Whether you’re an employer designing a plan or an employee evaluating options, a little planning goes a long way. Here’s how to make it simple and effective.

Step 1: Set a Clear Budget

Start with numbers. If you’re an employer, determine how much you can contribute per employee each month. This is your employer health benefits contribution. For example, you might set $400 per month for each employee to spend on health coverage. Knowing your budget upfront helps you stay in control of costs and plan smartly with a defined contribution health plan.

Step 2: Understand Employee Needs

Next, consider who will use the plan. Employees have different health needs — single workers, parents, and those with chronic conditions all require different coverage. Using tools like Individual Coverage HRA (ICHRA) or Qualified Small Employer HRA (QSEHRA) allows flexibility, letting employees choose plans that work for them. This keeps everyone happy and reduces confusion about the contributory health insurance plan.

Step 3: Compare Plan Options

Look at different insurance options, marketplaces, or health reimbursement arrangements (HRA) platforms. Check premiums, deductibles, and benefits. Employees should compare plans to find the best value. Remember, a defined contribution health plan gives them flexibility — they can pick a plan that suits their lifestyle and family needs.

Step 4: Ensure Compliance

No one wants trouble with the IRS or ACA. Make sure your plan meets ACA guidelines, IRS rules, and nondiscrimination laws. This protects both employers and employees while keeping the employer-sponsored health insurance plan safe and trustworthy.

Step 5: Communicate Clearly

A contributory health service scheme only works if everyone understands it. Explain how the employer contribution health insurance works, how reimbursements happen, and what employees are responsible for. Simple, clear communication reduces stress and ensures everyone gets the most from the plan.

Step 6: Use the Right Tools

Managing contributions and compliance can get tricky. Platforms for HR, payroll, or health reimbursement arrangements (HRA) make it easy to track contributions, reimbursements, and plan usage. With the right tools, your contributory health insurance plan runs smoothly.

Frequently Asked Questions About Contributory Health Service Schemes

To wrap things up, let’s answer some common questions about contributory health service schemes. These FAQs cover what employees and employers often wonder about defined contribution health plans, employer health benefits contribution, and health reimbursement arrangements (HRA).

1. What is a contributory health service scheme?

A contributory health service scheme is a health plan where both employers and employees share the cost of insurance. Instead of paying the full premium alone, contributions from everyone create a pool of funds to cover medical costs. It’s also called a defined contribution health plan or employer-sponsored health insurance.

2. How much should an employer contribute?

Contribution amounts vary by company size and budget. Many employers provide $300–$500 per employee per month, depending on coverage needs. Programs like Individual Coverage HRA (ICHRA) or Qualified Small Employer HRA (QSEHRA) allow flexible, tax-free contributions.

3. Can employees choose their own plans?

Yes! Modern contributory health insurance plans give employees flexibility. They can select plans that match their lifestyle, whether that means a lower deductible, specific doctor networks, or family coverage.

4. Are contributions tax-deductible?

Yes. Employer contributions to health reimbursement arrangements (HRA), ICHRA, and QSEHRA are generally tax-free for employees. Employers may also claim tax benefits, making employer health benefits contribution both affordable and smart.

5. Can small businesses offer these schemes?

Absolutely. Small businesses can adopt Qualified Small Employer HRA (QSEHRA) or other defined contribution health plans, providing employees with flexible coverage while maintaining budget control.

6. What are the compliance requirements?

All contributory health service schemes must follow ACA guidelines, IRS rules, and nondiscrimination laws. Compliance ensures fairness, avoids penalties, and maintains employee trust.

7. What happens if an employee has high healthcare costs?

Employees can combine employer health benefits contribution with personal funds to cover higher medical expenses. Programs like health reimbursement arrangements (HRA) make it easier to manage costs while still accessing quality care.