Looking for CT health insurance? Learn how to compare plans, lower costs, and find affordable Connecticut health coverage for individuals and families.

Introduction – Why CT Health Insurance Matters

Finding the right CT health insurance can feel confusing. With so many options, plans, and coverage types, it’s easy to get overwhelmed. But don’t worry! By the time you finish reading this guide, you’ll understand exactly how to navigate Connecticut health insurance, find the best health insurance Connecticut, and even save money with financial help.

Whether you’re looking for individual health insurance Connecticut, family health insurance Connecticut, or affordable health insurance Connecticut, having coverage is one of the smartest moves you can make. Medical bills can pile up quickly, and even a small hospital visit can cost hundreds or thousands of dollars. A good Connecticut health plan protects you, your family, and your wallet.

The Connecticut Health Insurance Marketplace is your gateway to exploring all the available options. It helps you compare plans, check costs, and see if you qualify for health insurance subsidies Connecticut or a premium tax credit Connecticut. Even if your income is modest, programs like Connecticut Medicaid and CHIP Connecticut ensure you and your loved ones can get the care you need without breaking the bank.

Choosing CT health coverage isn’t just about avoiding big bills. It’s about peace of mind. Imagine knowing that your kids’ regular checkups, vaccines, or emergencies are covered. Or picture the relief of having prescriptions, doctor visits, and hospital care included in your plan. That’s the power of Connecticut health insurance plans tailored to your needs.

In this guide, we’ll walk you through everything you need to know: types of insurance, costs, how to apply through Connecticut Health Connection, enrollment periods, and tips to pick the best cheap health insurance Connecticut plans. We’ll also highlight common mistakes to avoid, so you don’t waste time or money. By the end, you’ll feel confident choosing the right Connecticut health insurance provider, comparing plans, and enrolling with ease.

So, whether you’re new to Connecticut health insurance, switching plans, or just trying to find the most affordable health insurance Connecticut has to offer, stick with us. We’ll make the process simple, clear, and surprisingly easy to understand. Let’s dive in and get your coverage sorted!

Types of CT Health Insurance and Who They’re For

Understanding the different CT health insurance options is the first step to picking the right plan for you. Not all coverage is the same, and knowing the differences can save you money, time, and stress. Let’s break it down in simple, easy-to-understand terms.

1. Individual Health Insurance Connecticut

This type of Connecticut health insurance is designed for one person. If you don’t get insurance through your job, this is your main option. It covers doctor visits, hospital stays, prescriptions, and preventive care. Many plans also let you choose affordable health insurance Connecticut options, which can help reduce monthly premiums through subsidies.

Who it’s for:

- People without employer coverage

- Freelancers or gig workers

- Students or young adults

2. Family Health Insurance Connecticut

Family coverage is for households. One plan can cover you, your spouse, and children, sometimes at a lower cost per person than buying individual plans separately. These Connecticut health insurance plans often include pediatric care, maternity coverage, and prescription medications for the entire family.

Who it’s for:

- Families with children

- Couples planning to start a family

- Multi-generational households

3. Employer-Sponsored Health Insurance

Some companies provide CT health coverage for employees. Employer plans usually split costs between the company and employee, making them more affordable. They may also include dental, vision, and wellness programs.

Who it’s for:

- Full-time employees

- Part-time workers whose employers offer benefits

4. Medicaid Connecticut

If your income is low, Connecticut Medicaid offers free or low-cost coverage. This program is part of the U.S. government’s effort to ensure everyone has access to healthcare. It’s available for adults, children, pregnant women, and seniors who meet eligibility requirements.

Who it’s for:

- Low-income individuals or families

- Pregnant women

- Children needing coverage (CHIP Connecticut)

5. Private and Short-Term Plans

Some residents choose private insurance or short-term coverage. These plans can be cheaper but may not cover all medical needs. It’s important to carefully compare benefits if you’re looking at these options.

Who it’s for:

- People between jobs

- Those needing temporary coverage

- Anyone seeking best cheap health insurance Connecticut plans

How to Apply Through Connecticut Health Connection

Applying for CT health insurance doesn’t have to be confusing. The Connecticut Health Connection is the official state marketplace, designed to make finding and enrolling in the best health insurance Connecticut plans simple and straightforward. Let’s walk through it step by step.

1. Create Your Account

Start by visiting the Connecticut Health Connection website. You’ll need to create a secure account using your email and personal information. This account lets you explore plans, check eligibility for subsidies and premium tax credits Connecticut, and submit your application.

Tip: Keep your email and login details safe—this is your portal to all enrollment updates.

2. Fill Out Your Application

Once your account is ready, you’ll fill out your application. Here’s what you’ll need:

- Social Security numbers for everyone applying

- Income information (pay stubs or tax returns)

- Household details (family size, dependents)

This helps determine if you qualify for Connecticut Medicaid or CHIP Connecticut, or if you’re eligible for financial assistance with affordable health insurance Connecticut plans.

3. Compare Plans

After your application, you’ll see a list of available Connecticut health insurance plans. Pay attention to:

- Monthly premiums

- Deductibles, copays, and coinsurance

- Covered services (prescriptions, doctor visits, preventive care)

- Network of doctors and hospitals

Using these details, you can find the best cheap health insurance Connecticut plans that fit your needs.

4. Select and Enroll

Once you’ve chosen a plan, click “Enroll” to complete your registration. You’ll receive confirmation and ID cards, which you’ll need to access care.

Tip: Double-check your plan details and coverage start date. Missing a detail can cause delays in using your insurance.

5. Keep Your Information Updated

After enrollment, report any changes in income, household size, or address. This ensures you maintain eligibility for subsidies Connecticut and other financial help.

Understanding Plan Categories – Bronze, Silver, Gold, Platinum

When choosing CT health insurance, understanding plan categories is key. Not all plans are created equal, and the Bronze, Silver, Gold, and Platinum tiers help you balance cost and coverage. Let’s break it down in simple terms so you can pick the best health insurance Connecticut plan for your needs.

1. Bronze Plans

- What it is: Lowest monthly premiums but higher out-of-pocket costs

- Who it’s for: Healthy individuals who rarely visit the doctor

- Coverage: About 60% of medical costs covered by the plan; you pay the rest

Example: You pay a smaller monthly premium, but a hospital visit could cost more out-of-pocket.

2. Silver Plans

- What it is: Moderate premiums and moderate out-of-pocket costs

- Who it’s for: People who want a balance between monthly cost and coverage

- Coverage: Covers about 70% of medical costs

Extra Tip: Silver plans qualify for cost-sharing reductions Connecticut, lowering your deductible and copays if you meet income requirements.

3. Gold Plans

- What it is: Higher monthly premiums but lower out-of-pocket costs

- Who it’s for: People who expect regular medical care or have prescriptions

- Coverage: About 80% of medical costs covered

Example: You pay more each month, but doctor visits and treatments cost less.

4. Platinum Plans

- What it is: Highest monthly premiums, lowest out-of-pocket costs

- Who it’s for: Those who use healthcare frequently or have ongoing medical needs

- Coverage: Covers about 90% of medical costs

Example: Ideal for families with kids, chronic conditions, or anyone wanting maximum coverage with minimal surprise costs.

Choosing the Right Plan

To select the best Connecticut health insurance plan:

- Assess your health and medical needs

- Consider how often you visit the doctor or need prescriptions

- Balance monthly premiums with potential out-of-pocket costs

- Check if you qualify for subsidies or cost-sharing reductions Connecticut

Remember, the goal is to get affordable health insurance Connecticut that covers your essential medical needs without breaking your budget.

Health Insurance Costs in Connecticut

Understanding the cost of CT health insurance is crucial before choosing a plan. It’s not just about the monthly premium; there are several factors that affect what you’ll actually pay for Connecticut health insurance. Let’s break it down so it’s simple and easy to understand.

1. Monthly Premiums

Your premium is the amount you pay each month to keep your Connecticut health insurance plan active. Bronze plans usually have the lowest premiums, while Platinum plans have the highest. When choosing a plan, think about how much you can comfortably pay each month without straining your budget.

2. Deductibles

A deductible is what you pay out-of-pocket for medical services before your insurance starts covering costs. For example, a plan with a $2,000 deductible means you pay the first $2,000 of covered medical expenses. Typically:

- Bronze plans → higher deductibles

- Silver plans → moderate deductibles

- Gold/Platinum plans → lower deductibles

Tip: If you rarely visit the doctor, a higher deductible may save you money on premiums.

3. Copays and Coinsurance

Even after meeting your deductible, you may pay copays (a fixed amount per visit) or coinsurance (a percentage of the service cost). These costs vary by plan. Knowing these numbers helps you compare Connecticut health insurance plans accurately.

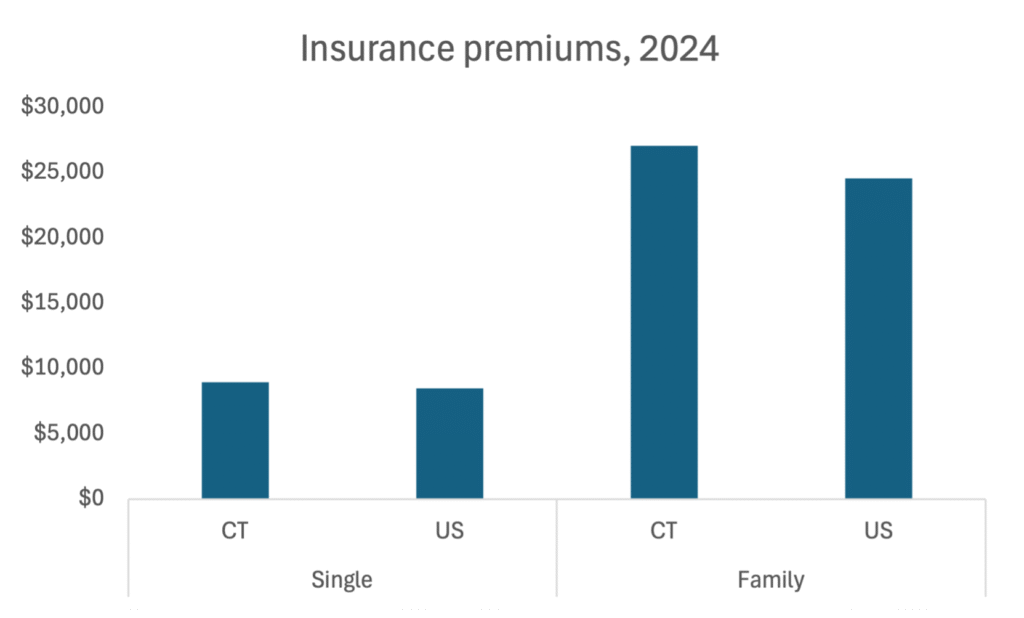

4. Family vs. Individual Coverage

Family plans cover multiple people, so monthly premiums are higher than individual plans. However, they often cost less per person compared to separate individual plans. If you have children, consider family health insurance Connecticut for full household coverage.

5. Financial Assistance and Subsidies

Many Connecticut residents qualify for health insurance subsidies Connecticut or premium tax credit Connecticut. These programs can lower your monthly premium and out-of-pocket costs significantly. Even best cheap health insurance Connecticut plans can become affordable through financial help.

6. Hidden Costs to Watch Out For

- Out-of-network doctor visits

- High-cost prescriptions

- Services not covered under your plan

Always review the plan details to avoid unexpected bills and ensure your coverage matches your needs.

Enrollment Periods in Connecticut

Knowing when to enroll in CT health insurance is just as important as knowing what plan to choose. Missing the enrollment period can leave you without coverage when you need it most. Let’s break it down clearly.

1. Open Enrollment Period

The Open Enrollment Period is the main window each year to sign up for Connecticut health insurance or make changes to your existing plan.

- Typically runs from November 1 to January 15 (dates may vary slightly each year).

- During this time, anyone can apply for individual health insurance Connecticut or family health insurance Connecticut.

- You can also switch plans, upgrade your coverage, or add dependents.

Tip: Even if your current plan seems fine, checking other Connecticut health insurance plans could save you money or give you better coverage.

2. Special Enrollment Periods

Outside of Open Enrollment, you may qualify for a Special Enrollment Period (SEP) if certain life events occur:

- Losing job-based coverage or Medicaid/CHIP

- Getting married or divorced

- Having a baby or adopting a child

- Moving to Connecticut from another state

- Changes in income that affect subsidy eligibility

During SEP, you can enroll in affordable health insurance Connecticut plans without waiting for the next Open Enrollment Period.

3. Why Deadlines Matter

Failing to enroll on time can mean:

- Losing coverage for months

- Missing out on subsidies or premium tax credits Connecticut

- Paying higher out-of-pocket costs for medical care

Mark your calendar and plan ahead to ensure your family or individual coverage starts without delays.

4. Tips to Stay on Track

- Sign up early during Open Enrollment to avoid website traffic or delays

- Keep all necessary documents ready (income info, Social Security numbers, household info)

- Review your plan each year; your needs may change

Tips to Compare CT Health Insurance Plans Effectively

Choosing the right CT health insurance plan isn’t just about picking the cheapest option. To get the most value, you need to compare plans carefully. Here’s how to do it in a simple, stress-free way.

1. Look at Monthly Premiums

Start with how much you’ll pay each month for your Connecticut health insurance plan. Lower premiums might seem appealing, but they often come with higher deductibles and out-of-pocket costs. Balance what you can pay monthly with potential medical expenses.

2. Check Deductibles and Out-of-Pocket Costs

- Deductible: The amount you pay before insurance covers your care

- Copays & Coinsurance: The amount you pay for visits and prescriptions

A plan with a higher premium but lower deductible might save you money if you expect frequent doctor visits. This is especially important for family health insurance Connecticut or those with ongoing prescriptions.

3. Compare Coverage Options

- Preventive care, like vaccines and screenings

- Hospital and specialist visits

- Prescription medications

- Mental health and wellness services

Make sure your preferred doctors and hospitals are in-network. Using out-of-network providers can get expensive quickly, even with insurance.

4. Review Plan Categories

- Bronze → lower premiums, higher costs when care is needed

- Silver → moderate premiums and costs, often eligible for cost-sharing reductions Connecticut

- Gold & Platinum → higher premiums, lower out-of-pocket costs

Choose a plan that matches your health needs and budget.

5. Check for Financial Assistance

Many Connecticut residents qualify for subsidies or premium tax credits Connecticut. Factor these into your comparisons to find affordable health insurance Connecticut that fits your income.

6. Consider Long-Term Needs

Think beyond the next year:

- Will you need family coverage next year?

- Are you planning for any major medical procedures?

- Are there chronic conditions to consider?

Comparing plans with a long-term perspective ensures you won’t be surprised by costs or gaps in coverage.

7. Use Comparison Tools

The Connecticut Health Connection website lets you see side-by-side comparisons of premiums, deductibles, and coverage options. These tools make it easier to choose the best health insurance Connecticut plans without guessing.

Common Mistakes to Avoid When Choosing CT Health Insurance

Choosing CT health insurance can feel overwhelming, and it’s easy to make mistakes that cost you time, money, or coverage. Let’s go over the most common errors and how to avoid them, so you can pick the best health insurance Connecticut plan with confidence.

1. Choosing the Cheapest Plan Without Checking Coverage

A low monthly premium might seem appealing, but it often comes with higher deductibles and limited benefits. Make sure your plan covers what you actually need: doctor visits, prescriptions, and preventive care.

Tip: Always compare plans side by side using the Connecticut Health Connection.

2. Ignoring Out-of-Network Costs

Some plans have smaller networks. Visiting a doctor outside your network can be expensive. Check if your preferred providers are in-network before enrolling in Connecticut health insurance plans.

3. Missing Enrollment Deadlines

The Open Enrollment Period and Special Enrollment Periods are strict. Missing deadlines means you might have to wait months for coverage or pay higher costs. Set reminders and plan ahead to ensure timely enrollment.

4. Overlooking Family Needs

If you have children or dependents, make sure your family health insurance Connecticut plan covers everyone adequately. Some plans exclude certain services or limit pediatric care, which could lead to surprises later.

5. Not Considering Financial Assistance

Many residents qualify for subsidies or premium tax credits Connecticut. Skipping this step could mean paying more than necessary. Always check your eligibility for affordable health insurance Connecticut before choosing a plan.

6. Focusing Only on Premiums

Premiums are important, but total costs matter more. Deductibles, copays, coinsurance, and prescription costs all add up. Always calculate the potential yearly expenses, not just monthly payments.

7. Failing to Review Plan Details Annually

Your health needs and finances can change. Review your plan each year to ensure it still fits your situation. Adjust coverage, switch plans, or update dependents as needed.

Tips & Strategies for Affordable CT Health Insurance

Finding CT health insurance that fits your budget doesn’t have to be stressful. With the right strategy, you can secure affordable health insurance Connecticut without giving up the care you need. Here are simple, smart ways to lower your costs and still get solid coverage.

1. Check If You Qualify for Financial Help

Many people pay more than they should because they skip this step. Through the Connecticut Health Connection, you may qualify for subsidies or premium tax credits Connecticut that lower your monthly premium. Some families also qualify for cost-sharing reductions Connecticut, which reduce deductibles and copays.

Tip: Even if you think you earn too much, apply anyway. Many people are surprised by how much help they get.

2. Choose the Right Plan Category

Picking the right plan can save you hundreds each year.

- If you rarely see a doctor, a Bronze plan may work.

- If you need regular care or prescriptions, Silver or Gold plans may cost less overall.

This balance helps you find the best cheap health insurance Connecticut plans for your lifestyle.

3. Compare Total Yearly Costs

Don’t focus only on monthly premiums. Add up:

- Premiums

- Deductibles

- Copays and coinsurance

- Prescription costs

Sometimes a slightly higher premium leads to lower total yearly expenses.

4. Use In-Network Doctors and Hospitals

Staying in-network keeps costs predictable and lower. Before enrolling in Connecticut health insurance, check that your preferred doctors and hospitals are included in the plan’s network.

5. Consider Family Coverage Carefully

If you have dependents, family health insurance Connecticut plans often cost less per person than separate individual plans. This is a smart way to protect everyone while saving money.

6. Review Your Plan Every Year

Health needs and prices change. Reviewing Connecticut health insurance plans annually helps ensure you’re still getting the best health insurance Connecticut for your budget and needs.

FAQs About CT Health Insurance

Got questions about CT health insurance? You’re not alone. Below are clear, simple answers to the most common questions people ask. No confusing terms—just straight talk to help you feel confident.

1. What is CT health insurance?

CT health insurance is medical coverage for people who live in Connecticut. It helps pay for doctor visits, hospital care, prescriptions, and preventive services. With the right Connecticut health insurance, you avoid big medical bills and get peace of mind.

2. Where do I apply for Connecticut health insurance?

You apply through Connecticut Health Connection, the official state marketplace. It lets you compare Connecticut health insurance plans, check prices, and see if you qualify for financial help.

3. Is there affordable health insurance in Connecticut?

Yes! Many residents qualify for affordable health insurance Connecticut options. Through subsidies or premium tax credits Connecticut, monthly premiums can be much lower than expected.

4. Who qualifies for Medicaid or CHIP in Connecticut?

If your income is limited, you may qualify for Connecticut Medicaid. Children in working families may qualify for CHIP Connecticut, which offers low-cost or free coverage for kids.

5. What is the best health insurance in Connecticut?

There’s no single best plan for everyone. The best health insurance Connecticut depends on your budget, health needs, and family size. Some people prefer low monthly costs, while others want lower costs when they visit the doctor.

6. Can I get family health insurance in Connecticut?

Absolutely. Family health insurance Connecticut plans cover spouses and children under one policy. This is often cheaper and easier than buying separate plans for each person.

7. What happens if I miss Open Enrollment?

If you miss Open Enrollment, you may need to wait unless you qualify for a Special Enrollment Period. Life events like moving, job loss, marriage, or having a baby can allow you to enroll in CT health coverage outside the regular window.

8. How do I know if a plan is really affordable?

Look beyond the monthly premium. Add up deductibles, copays, and prescriptions. Some best cheap health insurance Connecticut plans cost less over the year even if the monthly payment is slightly higher.

9. Can I change my plan later?

Yes. You can change plans during Open Enrollment or if you qualify for a Special Enrollment Period. Reviewing your Connecticut health insurance provider each year is a smart habit.

10. Why is having health insurance so important?

Without insurance, even a small emergency can cost thousands of dollars. CT health insurance protects your health, your family, and your finances—every single day.