Learn everything about Georgia health insurance, including plans, costs, eligibility, and how to find affordable coverage for individuals and families.

What Is Georgia Health Insurance?

Think of it like a safety net. You hope you never need it, but when something goes wrong, it’s there to protect you and your family

If you live in Georgia, you have access to different health insurance in Georgia options. These plans are made to follow U.S. health rules and are designed for real people with real budgets. Whether you are single, have a family, are self-employed, or work for a small company, there is a plan that can fit your life.

Many people first hear about Georgia health insurance plans through the government marketplace. This is where you can compare plans, check prices, and see if you qualify for savings. These plans are often called ACA plans, and they help make coverage more affordable for everyday people.

You may also hear terms like Georgia health insurance marketplace or Georgia ACA health insurance. Don’t let the names scare you. They simply mean health plans that follow U.S. rules and offer basic coverage like:

- Doctor visits

- Hospital care

- Prescriptions

- Preventive checkups

Some people buy private health insurance Georgia plans instead. These are offered by insurance companies and can be a good option if you want more choices or miss enrollment dates.

One of the biggest questions people ask is about cost. The cost of health insurance in Georgia depends on things like your age, income, and where you live. The good news is that many people qualify for help, making affordable health insurance Georgia possible even on a tight budget.

If money is a concern, there are options like Georgia health insurance for low income households. These programs exist to make sure no one is left without care when they need it most.

At its heart, Georgia health insurance is about peace of mind. It helps you sleep better at night, knowing a broken arm, sudden illness, or emergency won’t destroy your savings.

Health Insurance Options Available in Georgia

Now that you know what Georgia health insurance is, let’s talk about your choices. The good news? You’re not stuck with just one option. Georgia offers several health insurance in Georgia paths, so you can pick what fits your life, your family, and your budget.

1️⃣ Individual Health Insurance in Georgia

If you’re buying coverage just for yourself, individual health insurance Georgia plans are a common choice. These plans work well if you’re single, self-employed, or between jobs. You pay a monthly amount, and the plan helps cover doctor visits, hospital care, and medicine.

Many people choose these plans through the Georgia health insurance marketplace, where you can compare prices and see if you qualify for savings.

2️⃣ Family Health Insurance Georgia

Have a spouse or kids? family health insurance Georgia plans cover everyone under one policy. This is often cheaper and easier than buying separate plans for each person. Families like this option because it offers steady care for checkups, school physicals, and unexpected emergencies.

3️⃣ Employer Health Insurance Georgia

If you work for a company, your job may offer employer health insurance Georgia. This means your employer helps pay part of the monthly cost, which can make coverage more affordable. Many workers choose this because it’s simple and comes straight out of their paycheck.

4️⃣ Self-Employed and Freelancer Options

If you work for yourself, don’t worry—you’re not left out. self employed health insurance Georgia plans are designed for freelancers, gig workers, and small business owners. These plans give you flexibility and control while still offering strong protection.

5️⃣ Georgia ACA Health Insurance Plans

ACA plans follow U.S. health rules and are available through the marketplace. Georgia ACA health insurance covers essential care and cannot deny you because of health issues. These plans are popular because they are fair, reliable, and often come with financial help.

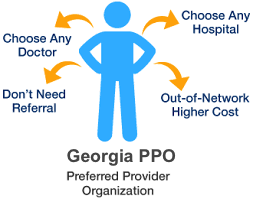

6️⃣ Private Health Insurance Georgia

Some people prefer private health insurance Georgia because it offers more plan choices or faster access to certain doctors. This can be helpful if you want extra flexibility or missed open enrollment.

7️⃣ Low-Income Health Insurance Options

If money is tight, Georgia health insurance for low income households may qualify for special programs that lower costs or provide coverage at little to no cost. These options exist to make sure everyone can get care when they need it most

Georgia Health Insurance Marketplace Explained

If you’re looking for Georgia health insurance and don’t get coverage through a job, this is usually the best place to start.

What Is the Marketplace?

The marketplace is where Georgia ACA health insurance plans are sold. These plans follow U.S. health rules and must cover basic care like doctor visits, hospital stays, and medicine. They also protect you from being denied because of health problems.

In simple words, the marketplace helps you:

- Compare plans side by side

- See real prices

- Check if you qualify for savings

Who Can Use the Georgia Health Insurance Marketplace?

Almost anyone living in Georgia can use it, including:

- Individuals

- Families

- Self-employed workers

- First-time buyers

If you don’t have employer health insurance Georgia, the marketplace is designed for you.

How the Marketplace Works (Easy Steps)

Here’s how people usually get health insurance in Georgia through the marketplace:

1️⃣ Create an account

2️⃣ Enter basic info like age, income, and zip code

3️⃣ See available Georgia health insurance plans

4️⃣ Compare coverage and monthly cost

5️⃣ Choose the plan that feels right

That’s it. No pressure. No confusing sales talk.

Can You Save Money on Marketplace Plans?

Yes—and this is the best part

Many people qualify for help that lowers the cost of health insurance in Georgia. These savings can reduce monthly payments and make affordable health insurance Georgia possible, even on a tight budget.

If your income is lower, you may also qualify for Georgia health insurance for low income programs, which can lower costs even more.

Marketplace vs Private Health Insurance

Some people compare the marketplace with private health insurance Georgia. The big difference is that marketplace plans often include savings based on income, while private plans may offer more flexibility but fewer discounts.

How Much Does Health Insurance Cost in Georgia?

Let’s talk about money—because that’s usually the first thing people worry about

The cost of health insurance in Georgia can feel confusing at first, but once you understand what affects the price, it becomes much easier to plan.

On average, people paying for Georgia health insurance spend a few hundred dollars each month. Some pay less, some pay more. The final number depends on your personal situation, not just the plan itself.

What Affects the Cost of Health Insurance in Georgia?

Here are the biggest factors that decide how much you pay:

1️⃣ Your Age

Younger people usually pay less. Older adults often pay more because they may need more care. This is a normal part of health insurance in Georgia pricing.

2️⃣ Your Income

Your income plays a huge role. Many people qualify for savings that lower monthly costs. This is how affordable health insurance Georgia becomes possible for so many families.

If your income is lower, you may also qualify for Georgia health insurance for low income programs, which can greatly reduce what you pay.

3️⃣ Where You Live in Georgia

Insurance prices can change based on location. Living in a city or rural area can affect the Georgia health insurance plans available to you and their prices.

4️⃣ The Type of Plan You Choose

Plans with lower monthly payments usually come with higher costs when you visit the doctor. Plans with higher monthly payments often cover more right away. Choosing the right balance helps control the cost of health insurance in Georgia.

5️⃣ Marketplace vs Private Plans

If you buy coverage through the Georgia health insurance marketplace, you may qualify for savings that lower your monthly bill. With private health insurance Georgia, prices may be higher, but you might get more plan choices.

Real Talk: Can Health Insurance Be Affordable?

Yes—absolutely

Many people are surprised to learn how much help is available. With savings and smart choices, Georgia ACA health insurance plans can cost far less than expected.

Some families pay under $100 a month after savings. Others pay more for extra coverage. The key is choosing what fits your life, not what looks fancy on paper.

Why Cost Shouldn’t Stop You

Skipping health insurance in Georgia might feel like saving money, but one accident or illness can cost thousands. Insurance protects your wallet, your health, and your peace of mind.

Smart Ways to Lower the Cost of Health Insurance in Georgia

If you’re worried about money, you’re not alone. The good news is there are real, simple ways to lower the cost of health insurance in Georgia without giving up the care you need

Let’s break it down in a clear and friendly way.

1️⃣ Use the Georgia Health Insurance Marketplace

One of the easiest ways to save is by using the Georgia health insurance marketplace. Many people qualify for financial help that lowers monthly payments. This help can turn regular plans into affordable health insurance Georgia options almost overnight.

If you skip the marketplace and go straight to private health insurance Georgia, you may miss out on these savings.

2️⃣ Take Advantage of Income-Based Savings

Your income matters—a lot. If you earn within certain limits, Georgia ACA health insurance plans may offer big discounts. These savings help cover part of your monthly bill and sometimes lower what you pay at the doctor too.

People with tighter budgets may also qualify for Georgia health insurance for low income programs, which can make coverage extremely affordable.

3️⃣ Choose Only the Coverage You Actually Need

More coverage isn’t always better. Picking a plan that fits your real needs can reduce the cost of health insurance in Georgia. For example:

- Fewer doctor visits → lower monthly cost

- Regular care needs → stronger coverage upfront

Matching the plan to your lifestyle keeps you from overpaying.

4️⃣ Compare Plans Carefully

Never choose the first plan you see. Compare multiple Georgia health insurance plans side by side. Look at monthly cost, doctor visits, and medicine coverage—not just the price tag.

A few extra minutes of comparing can save you hundreds of dollars each year

5️⃣ Enroll at the Right Time

Signing up during open enrollment gives you the best prices and plan choices. Missing deadlines can force you into more expensive health insurance in Georgia options later.

6️⃣ Ask for Help When Needed

Insurance doesn’t have to be confusing. Licensed helpers can explain Georgia health insurance options in plain English and help you avoid costly mistakes.

Peace of Mind Matters

Lowering the price is important, but so is feeling safe and secure

The right plan protects you from surprise bills and gives you confidence when life throws the unexpected your way.

Who Qualifies for Health Insurance in Georgia?

This is a question many people ask, and the answer is simpler than you might think

Most people living in Georgia qualify for some form of Georgia health insurance. The key is knowing which option fits your situation.

Let’s walk through it step by step.

Basic Requirements to Qualify

You can usually qualify for health insurance in Georgia if you:

- Live in the state of Georgia

- Are a U.S. citizen or legally present

- Are not currently in prison

That’s it. No complicated rules or trick questions.

Income-Based Eligibility

Your income plays a big role in determining your options. Many people qualify for savings that lower the cost of health insurance in Georgia.

If your income is lower, you may qualify for Georgia health insurance for low income programs. These programs exist to make sure people can still see a doctor and get medicine, even on a limited budget.

Employment Status Does Not Disqualify You

You can qualify for Georgia health insurance plans whether you:

- Work full-time

- Work part-time

- Are self-employed

- Are between jobs

If you don’t have employer health insurance Georgia, the Georgia health insurance marketplace is built specifically for you.

Family and Household Size Matters

Your household size affects both eligibility and savings. Families may qualify for bigger discounts, making affordable health insurance Georgia easier to access for parents and children.

Special Situations That Still Qualify

You may qualify for Georgia ACA health insurance even if:

- You recently lost a job

- You got married or divorced

- You had a baby

- You moved to Georgia

These life changes can open special enrollment windows.

Private Health Insurance Eligibility

Almost anyone can apply for private health insurance Georgia, regardless of income. However, these plans usually don’t offer the same savings as marketplace options.

Why Knowing Your Eligibility Matters

Understanding your eligibility helps you avoid overpaying and missing out on help. Many people assume they don’t qualify—only to find out they actually do.

The right Georgia health insurance plan can protect your health and your finances at the same time

Open Enrollment & Special Enrollment in Georgia

Timing matters—a lot

Even if you qualify for Georgia health insurance, you must sign up at the right time. Missing the window can mean waiting months or paying more than you should.

Let’s make this easy to understand.

What Is Open Enrollment in Georgia?

Open enrollment is the main time each year when you can sign up for health insurance in Georgia through the Georgia health insurance marketplace.

During open enrollment, you can:

- Get new coverage

- Change your current plan

- Compare Georgia health insurance plans

This is the best time to find affordable health insurance Georgia with savings.

What Happens If You Miss Open Enrollment?

If you miss it, you usually can’t buy Georgia ACA health insurance right away. But don’t panic—this is where special enrollment comes in.

What Is Special Enrollment?

Special enrollment lets you sign up outside open enrollment if you have a major life change. These changes are called “qualifying events.”

Common qualifying events include:

- Losing a job or employer health insurance Georgia

- Getting married or divorced

- Having a baby or adopting a child

- Moving to Georgia

- Changes in income

If one of these happens, you usually have about 60 days to enroll.

Why Special Enrollment Is So Important

Special enrollment protects you when life changes suddenly. It makes sure you don’t go without Georgia health insurance during stressful times.

Private Health Insurance and Enrollment

With private health insurance Georgia, enrollment rules may be more flexible. However, these plans may not offer the same protections or savings as marketplace plans.

Don’t Wait Until It’s Too Late

Missing enrollment can lead to gaps in coverage and high medical bills. Signing up on time helps keep the cost of health insurance in Georgia under control and gives you peace of mind

How to Choose the Best Health Insurance in Georgia

Choosing the right plan doesn’t have to feel scary or confusing

The best Georgia health insurance plan is the one that fits your life, not someone else’s. Let’s walk through it together in a simple, stress-free way.

1️⃣ Start With Your Real Needs

Ask yourself a few easy questions:

- Do you visit the doctor often?

- Do you take regular medicine?

- Are you covering just yourself or your family?

Your answers help narrow down the right Georgia health insurance plans without wasting money.

2️⃣ Look Beyond the Monthly Price

It’s tempting to choose the cheapest plan, but that can backfire. Some low-cost plans charge more when you see a doctor. Balancing monthly cost and care expenses helps control the cost of health insurance in Georgia.

This is how people find truly affordable health insurance Georgia—not just the lowest price on paper.

3️⃣ Check Doctors and Hospitals

Always make sure your doctors are included. A plan that doesn’t cover your favorite doctor may cause stress later. This applies to both health insurance in Georgia from the marketplace and private health insurance Georgia options.

4️⃣ Compare Marketplace Plans First

The Georgia health insurance marketplace often offers the best value, especially if you qualify for savings. Georgia ACA health insurance plans are fair, reliable, and protect you from surprise coverage problems.

5️⃣ Think About Your Family

If you have kids or dependents, family health insurance Georgia plans can simplify everything. One plan, one bill, and steady coverage for everyone you love

6️⃣ Don’t Forget Future Changes

Life changes fast. A good Georgia health insurance plan should still work if you change jobs, move, or have a baby. Flexibility matters more than people realize.

7️⃣ Ask for Help if You Feel Stuck

You don’t have to figure this out alone. Getting help can save you time, money, and stress—and help you avoid mistakes that raise the cost of health insurance in Georgia.

Trust Your Choice

The right plan gives you confidence. You’ll feel safer knowing your health and wallet are protected.

Common Mistakes People Make When Buying Health Insurance in Georgia

Buying Georgia health insurance is a big decision, and small mistakes can cost a lot of money and peace of mind

The good news? Most mistakes are easy to avoid once you know what to watch out for.

Let’s go over the most common ones.

1️⃣ Choosing the Cheapest Plan Without Looking Deeper

A low monthly price looks great at first, but it can lead to high costs later. Some plans charge more when you visit the doctor or need medicine. Always balance the monthly cost with total care costs to truly control the cost of health insurance in Georgia.

2️⃣ Ignoring Available Savings

Many people don’t realize they qualify for help. Skipping the Georgia health insurance marketplace can mean missing out on savings that make affordable health insurance Georgia possible.

3️⃣ Not Checking Doctor Networks

If your doctor isn’t covered, you could end up paying full price. Always check doctor and hospital lists when choosing Georgia health insurance plans or private health insurance Georgia options.

4️⃣ Missing Enrollment Deadlines

Missing open enrollment can leave you uninsured for months. Knowing enrollment rules protects your access to health insurance in Georgia when you need it most.

5️⃣ Buying More Coverage Than You Need

More coverage isn’t always better. Paying for extras you don’t use raises the cost of health insurance in Georgia without adding real value.

6️⃣ Forgetting Life Changes

Marriage, babies, job changes, or moving can affect your Georgia health insurance. Forgetting to update your plan can lead to coverage gaps.

7️⃣ Assuming Private Plans Are Always Better

Some people jump straight to private health insurance Georgia without checking marketplace options. This can mean fewer protections and higher costs.

Protect Yourself From Stress

Avoiding these mistakes saves money and worry. The right Georgia health insurance plan should make you feel calm, not confused

Georgia Health Insurance for First-Time Buyers

If this is your first time shopping for Georgia health insurance, take a deep breath

You’re not alone, and you don’t need to be an expert to make a smart choice.

Start Simple

First-time buyers often think health insurance in Georgia is more complicated than it really is. The truth is, you just need to focus on the basics:

- Monthly cost

- Doctor visits

- Medicine coverage

You don’t need to understand every detail to choose a good plan.

Use the Marketplace First

The Georgia health insurance marketplace is usually the safest place to begin. It lets you compare Georgia health insurance plans side by side and shows if you qualify for savings.

Most first-time buyers are surprised by how affordable health insurance Georgia can be once savings are applied.

Don’t Be Afraid of ACA Plans

Georgia ACA health insurance plans follow clear rules and protect you from being denied coverage. They cover basic care and are designed to be fair and reliable—perfect for beginners.

Watch the Total Cost

Many first-time buyers only look at the monthly price. That’s a mistake. Pay attention to what you pay when you see a doctor. This helps keep the cost of health insurance in Georgia under control.

Avoid Pressure

You don’t need to rush. Take your time comparing options. Whether you choose marketplace plans or private health insurance Georgia, the best decision is an informed one.

Ask Questions—It’s Okay

No question is silly. Asking for help can prevent costly errors and help you feel confident about your Georgia health insurance choice.

You’re Doing the Right Thing

Getting health insurance is a smart step toward protecting your future. It shows care for yourself and your loved one

Frequently Asked Questions About Georgia Health Insurance

What Is the Cheapest Health Insurance in Georgia?

The cheapest option depends on your income, age, and location. Many people find the lowest prices through the Georgia health insurance marketplace, especially when savings apply. These savings make affordable health insurance Georgia possible for thousands of families.

Can I Get Health Insurance in Georgia Without a Job?

Yes! You do not need a job to get health insurance in Georgia. If you don’t have employer health insurance Georgia, you can buy coverage through the marketplace or choose private health insurance Georgia plans.

How Do I Know If I Qualify for Savings?

Savings are based on income and household size. When you apply for Georgia ACA health insurance, the marketplace automatically checks if you qualify. Many people are surprised to learn they do.

What If My Income Changes During the Year?

If your income changes, update your information right away. This helps keep your cost of health insurance in Georgia accurate and avoids problems later.

Is Health Insurance Required in Georgia?

There is no state penalty for not having coverage, but going without Georgia health insurance is risky. One accident can cost thousands and create long-term stress.

What’s Better: Marketplace or Private Health Insurance?

Marketplace plans often offer better protection and savings. Private health insurance Georgia may offer more choices, but usually without income-based help.

Can Low-Income Families Get Health Insurance in Georgia?

Yes. Georgia health insurance for low income households may qualify for special programs that reduce or even eliminate monthly costs.

Can I Change My Plan Later?

You can change plans during open enrollment or after a qualifying life event. This keeps your Georgia health insurance plans flexible as your life changes.

Final Reassurance

Health insurance doesn’t have to be scary. With the right information, Georgia health insurance becomes a tool that protects your health, your money, and your peace of mind

Final Thoughts and Next Steps for Georgia Health Insurance

Let’s quickly tie everything together in a simple, helpful way.

What You Should Remember

- Health insurance in Georgia protects you from high medical bills

- There are many Georgia health insurance plans for different needs

- The Georgia health insurance marketplace is often the best place to start

- Georgia ACA health insurance offers strong protection and fair pricing

- Many people qualify for savings, making affordable health insurance Georgia a real option

- Private health insurance Georgia can work in certain situations, but may cost more

- Georgia health insurance for low income households may receive extra help

Your Next Steps (Simple and Smart)

1️⃣ Review your personal needs and budget

2️⃣ Check the Georgia health insurance marketplace for savings

3️⃣ Compare Georgia health insurance plans carefully

4️⃣ Enroll during open or special enrollment

5️⃣ Ask questions if anything feels unclear

Why This Matters

Health insurance isn’t just paperwork. It’s peace of mind. It’s knowing you can see a doctor when something feels wrong. It’s protecting your family from sudden, scary bills