Explore the NH Health Insurance Marketplace. Compare plans, find affordable options, check subsidies, and enroll in qualified health plans today.

What is the NH Health Insurance Marketplace?

Imagine shopping for health coverage the same way you compare phones or shoes. Simple, side-by-side choices. That is exactly what the NH health insurance marketplace is made for. It is an easy place where people in New Hampshire can look at plans, compare costs, and pick the one that fits their life and budget.

The marketplace is part of the Affordable Care Act marketplace and New Hampshire uses the federal site called HealthCare.gov marketplace. This means you go online, answer a few questions, and see different NH individual health insurance plans all in one place. Think of it as a big health-plan supermarket.

The best part? You do not need to be an expert. You just need clear information, and that is what this guide gives you.

Through the health insurance marketplace, many people qualify for health insurance subsidies and premium tax credits that lower monthly costs. That is real money saved. If your income is limited, Marketplace financial help NH can even make plans close to zero dollars. Families, kids, single adults, and seniors all use it. If you are self-employed or a gig worker, there are Marketplace coverage options for self-employed in NH too.

New Hampshire uses a federally facilitated marketplace, which simply means the federal government runs it. You still get local plans and doctors. You just sign up through one national website. During open enrollment health insurance NH, anyone can apply. If you have a big life change, like a new baby or job loss, you may qualify for a special enrollment period as well.

Inside the marketplace, you will see qualified health plans in metal levels: Bronze, Silver, Gold, and Platinum. Each level covers different amounts and has different prices. The marketplace helps with health insurance comparison NH, so you are not guessing.

Many people search questions like how to apply for health insurance marketplace in NH, when open enrollment starts and ends in NH, or do I qualify for Marketplace tax credits in NH. You are not alone. Those questions are normal, and this article will walk you through the answers step by step.

You will also learn about best NH marketplace health insurance plans for families, affordable marketplace insurance options NH, top Marketplace insurers in New Hampshire, and financial assistance options for NH Marketplace coverage so you feel confident, calm, and in control.

How the NH Health Insurance Marketplace Works

The NH health insurance marketplace may look complicated at first, but once you understand the steps, it feels surprisingly simple. Think of it like this: you answer questions, you see your choices, and you pick what works best. That’s it.

The marketplace is part of the Affordable Care Act marketplace, which was created to help people get fair, affordable coverage. New Hampshire uses the HealthCare.gov marketplace, which means everything happens on one trusted website. This is called a federally facilitated marketplace, but don’t worry — that just means the federal government runs the website while you still get local New Hampshire plans.

Here is how it works in real life:

- You enter your basic details such as age, family size, and where you live.

- The site shows you NH individual health insurance plans you can choose from.

- You compare prices, doctors, hospitals, and coverage.

- You apply for health insurance subsidies and premium tax credits if you qualify.

- You pick a plan and enroll.

The marketplace shows plans in levels called metal tiers: Bronze, Silver, Gold, and Platinum. These are qualified health plans that must cover important services such as doctor visits, medicine, emergencies, and hospital care. You can use the marketplace for health insurance comparison NH, so you never have to guess which plan is right.

Many people worry about cost. The good news is that the marketplace helps with Marketplace financial help NH. If your income fits the rules, premium tax credits can lower what you pay each month. Some people even unlock affordable marketplace insurance options NH that cost very little. The marketplace also offers financial assistance options for NH Marketplace coverage, which helps families, students, and people between jobs.

If you are self-employed or work gig jobs, there are Marketplace coverage options for self-employed in NH so you do not feel left behind.

You can only sign up during open enrollment health insurance NH, unless you qualify for a special enrollment period because of life changes like marriage, moving, losing coverage, or having a baby.

So yes, the marketplace works — and it works for real people like you. It helps you find top Marketplace insurers in New Hampshire, see your choices in one place, and pick coverage that protects your health and your wallet.

You are not just buying insurance. You are buying peace of mind.

Who Can Use the NH Health Insurance Marketplace?

You might be wondering, “Do I even qualify for the NH health insurance marketplace?” The answer is usually yes — and the rules are easier than most people think.

The marketplace is part of the Affordable Care Act marketplace, and New Hampshire residents use the HealthCare.gov marketplace, which is the trusted, federally facilitated marketplace. If you live in New Hampshire and don’t already have affordable coverage from work, you can usually shop for NH individual health insurance plans here.

To use the marketplace, you generally need to:

- live in New Hampshire

- be a U.S. citizen or legal resident

- not be in jail

- not already have Medicare that covers you fully

That’s it. Simple.

The marketplace is especially helpful if you don’t get insurance through an employer. That includes part-time workers, students, stay-at-home parents, and people who run small businesses. If you work for yourself, drive rideshare, deliver food, or freelance online, there are Marketplace coverage options for self-employed in NH designed for you.

Money matters too. If your income falls within certain ranges, you may qualify for health insurance subsidies, premium tax credits, and Marketplace financial help NH. These programs lower your monthly bill and sometimes even reduce doctor visit costs. That means real savings — and less stress.

Many people ask:

- Do I earn too much?

- Do I earn too little?

- Do I have to pay full price?

Here’s the comforting part: the marketplace calculates it for you automatically. When you apply, it checks whether you qualify for financial assistance options for NH Marketplace coverage. If you do, you will see cheaper plans, including affordable marketplace insurance options NH.

Life changes also matter. You can enroll during open enrollment health insurance NH, but if something big happens — like losing job coverage, moving, getting married, or having a baby — you may get a special enrollment period. That means you don’t have to wait a whole year to apply.

Every plan you see is a qualified health plan, meaning it must cover important services such as hospital visits, emergency care, pregnancy care, mental health help, and prescriptions.

So if you’re worried you don’t qualify, breathe. Most people do. And yes, that includes families, individuals, and even people going through tough financial times.

Costs in the NH Health Insurance Marketplace

Money can feel scary, especially when it comes to health coverage. The good news is this: the NH health insurance marketplace is built to help you find plans that fit your wallet, not just your medical needs. You can explore plans, compare prices, and see your savings before you ever sign up.

In the Affordable Care Act marketplace, every plan shows its price clearly. When you use the HealthCare.gov marketplace, you will see your monthly payment, your deductible, and what the plan covers. This system is part of the federally facilitated marketplace, and its goal is simple — no secrets, just clear numbers.

Your cost is not the same as someone else’s. It depends on:

- your age

- the number of people in your family

- where you live

- whether you smoke

- which metal level you select

You will choose from NH individual health insurance plans in Bronze, Silver, Gold, or Platinum. Bronze plans usually have lower monthly payments and higher costs when you get care. Gold and Platinum plans cost more each month but cover more when you need help. These are all qualified health plans, so they must include important services like doctor visits, emergencies, hospital stays, and medicine.

Here’s the exciting part. Many people don’t pay full price. The marketplace offers health insurance subsidies and premium tax credits that reduce costs. That is called Marketplace financial help NH, and it can make a huge difference. You could unlock affordable marketplace insurance options NH or even plans with very low premiums.

Families, students, and people working gig jobs often qualify for financial assistance options for NH Marketplace coverage. Even if your income changed recently, the marketplace checks again. You simply answer questions and the system calculates help for you automatically.

If you run your own business or work for yourself, don’t worry. There are Marketplace coverage options for self-employed in NH designed with you in mind.

You can review costs during open enrollment health insurance NH each year. If you experience major life changes, such as job loss or marriage, you may join through a special enrollment period instead.

Understanding costs doesn’t have to feel confusing or overwhelming. With health insurance comparison NH, you see plans side-by-side. You can also look at top Marketplace insurers in New Hampshire and pick what feels safe and affordable.

Health coverage is not just a bill. It is protection, comfort, and peace of mind. It means knowing that when life surprises you, you are not facing it alone — and the NH health insurance marketplace helps make that possible.

How to Enroll in the NH Health Insurance Marketplace

Enrolling in the NH health insurance marketplace doesn’t have to feel scary or complicated. Think of it like following a simple recipe — a few clear steps and you’re done. By the end, you’ll have coverage that protects you and your family.

Here’s how to get started:

Step 1: Visit the HealthCare.gov Marketplace

Since New Hampshire uses a federally facilitated marketplace, you’ll go to HealthCare.gov marketplace. This is the official site for NH individual health insurance plans, and it’s safe, secure, and easy to use.

Step 2: Create an Account

You’ll need a few basic things: name, date of birth, address, and email. Once you create your account, you can start exploring qualified health plans, compare costs, and check health insurance subsidies.

Step 3: Enter Your Household and Income Information

This step is important because it determines your eligibility for Marketplace financial help NH. Include everyone in your household, your total income, and your tax-filing status. This is how the system calculates premium tax credits and other financial assistance options for NH Marketplace coverage.

Step 4: Compare Plans

Now comes the fun part — looking at your options. You’ll see NH individual health insurance plans in Bronze, Silver, Gold, and Platinum tiers. Use health insurance comparison NH to check:

- Monthly premiums

- Deductibles and out-of-pocket costs

- Doctor and hospital networks

- Prescription coverage

Pay attention to affordable marketplace insurance options NH that fit your budget and needs. Don’t just pick the cheapest — think about your health, your family, and future medical care.

Step 5: Apply for Financial Assistance

The marketplace will automatically apply any health insurance subsidies or premium tax credits you qualify for. If your income changed recently, the system can update your help. Many families and self-employed individuals use Marketplace coverage options for self-employed in NH to make premiums manageable.

Step 6: Enroll and Pay Your First Premium

Once you pick a plan, submit your application and pay the first premium to activate coverage. You’ll receive confirmation and an insurance card. You’re officially covered!

Step 7: Keep Your Info Updated

Life changes like a new baby, a move, or job change? Report it immediately. That ensures you stay eligible for special enrollment periods and financial assistance options for NH Marketplace coverage.

Pro Tip: Always check top Marketplace insurers in New Hampshire to ensure your favorite doctors are in-network. This saves stress later and guarantees your care is covered.

By following these steps, enrolling in the NH health insurance marketplace becomes simple, stress-free, and smart. You’re not just signing up for insurance — you’re securing peace of mind for yourself and your family.

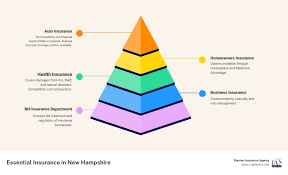

Understanding Plan Types and Coverage Levels in NH

When you shop in the NH health insurance marketplace, you’ll notice something called metal tiers — Bronze, Silver, Gold, and Platinum. Don’t worry, it’s not complicated. Think of it as a way to understand how much the plan pays and how much you pay. This is part of all qualified health plans, and it’s designed to help you make smart choices.

Bronze Plans

Bronze plans have the lowest monthly premium, which means you pay less each month. The catch? You’ll pay more out-of-pocket when you see a doctor or go to the hospital. These plans are great if you’re generally healthy, rarely need care, or want to pay a small premium every month.

Silver Plans

Silver plans are the most common choice. They balance monthly costs with coverage. If you qualify for health insurance subsidies or premium tax credits, a Silver plan can be very affordable. Silver plans are perfect if you want moderate monthly payments but still want solid coverage when you need care.

Gold Plans

Gold plans have higher monthly premiums but cover more of your medical costs. This means fewer surprises when you go to the doctor. They are ideal for families, people with ongoing medical needs, or those who want peace of mind that most care is covered. Using health insurance comparison NH, you can see if a Gold plan is worth it for your situation.

Platinum Plans

Platinum plans are for people who want maximum coverage. Your monthly payments are higher, but almost everything is covered. If you use the doctor frequently or need regular prescriptions, this plan might save money overall. It’s especially helpful for those using Marketplace coverage options for self-employed in NH, who want predictable costs.

Comparing Plans

When you compare NH individual health insurance plans, look beyond the premium. Check deductibles, out-of-pocket costs, and which doctors are in-network. The top Marketplace insurers in New Hampshire may differ in coverage, so side-by-side comparison is key. Don’t forget to factor in affordable marketplace insurance options NH that might be available with Marketplace financial help NH.

Tips

- Bronze = low monthly, high out-of-pocket

- Silver = balance, good for subsidies

- Gold = high coverage, moderate cost

- Platinum = max coverage, higher monthly cost

Using the NH health insurance marketplace wisely means picking a plan that fits your health needs, your budget, and your lifestyle. By understanding these tiers and financial assistance options for NH Marketplace coverage, you’ll make the choice that protects you and your family without breaking the bank.

Financial Help, Subsidies, and Premium Tax Credits in NH

Paying for health insurance can feel stressful, but the NH health insurance marketplace is designed to make it easier. One of the best parts? Financial help. Through health insurance subsidies and premium tax credits, you can lower your monthly bills and make coverage affordable — sometimes even close to zero dollars.

What Are Premium Tax Credits?

Premium tax credits are like a discount on your monthly insurance payment. The government calculates your income and household size to determine how much help you get. If you qualify, the Marketplace financial help NH will automatically reduce the cost of your NH individual health insurance plans.

Many families and individuals find that these credits make affordable marketplace insurance options NH possible. It’s a lifesaver if you’re worried about high monthly costs.

Cost-Sharing Reductions

If your income is on the lower side, you may also qualify for cost-sharing reductions. This means you pay less when you go to the doctor, fill prescriptions, or have other medical care. Combined with financial assistance options for NH Marketplace coverage, these reductions can make healthcare manageable for anyone.

Who Qualifies for Financial Assistance?

Most people earning between 100% and 400% of the federal poverty level are eligible. This includes families, single adults, students, and even people using Marketplace coverage options for self-employed in NH. The marketplace automatically checks eligibility, so you don’t have to guess.

How to Apply for Help

When you fill out your application on HealthCare.gov marketplace, you’ll enter income, household size, and some basic details. The system calculates your health insurance subsidies and premium tax credits instantly. You can see your discounted premium before choosing your plan. No surprises, no confusion.

Why It Matters

Without these programs, some NH individual health insurance plans could be expensive. With subsidies and tax credits, you can access top Marketplace insurers in New Hampshire at a price you can afford. It’s designed to make sure everyone has a chance at coverage — even families, self-employed workers, and people with limited income.

Pro Tip

Use the marketplace’s tools to compare affordable marketplace insurance options NH side by side. This ensures you not only get coverage but also save as much money as possible.

Common Mistakes and How to Avoid Them in NH Marketplace

Shopping for insurance can be confusing, and many people make mistakes that cost time, money, or coverage. The good news? You can avoid them by knowing what to watch for in the NH health insurance marketplace.

1. Choosing the Cheapest Plan Without Checking Coverage

It’s tempting to pick a low premium, but Bronze plans often come with high out-of-pocket costs. Use health insurance comparison NH to see what each plan really covers. Check deductibles, co-pays, and whether your doctors are included. Sometimes spending a little more monthly saves a lot later.

2. Ignoring Financial Help

Many people forget to apply for health insurance subsidies or premium tax credits. You could miss out on Marketplace financial help NH or affordable marketplace insurance options NH. Always enter your income and household info to see your discounts.

3. Forgetting Special Enrollment Periods

Life changes like marriage, moving, or losing a job allow a special enrollment period. Missing this window can mean waiting until next year. Don’t let timing slip by — it could leave you uninsured.

4. Not Considering Self-Employed Options

If you are freelancing or running a small business, you might ignore Marketplace coverage options for self-employed in NH. These plans are designed for you, often with the same subsidies and benefits as everyone else.

5. Skipping Plan Comparison

Many people choose a plan without checking the top Marketplace insurers in New Hampshire. Comparing networks, costs, and benefits is crucial. Use the marketplace’s side-by-side tools to make a smart choice.

6. Focusing Only on Premiums

Premiums aren’t the whole picture. Look at deductibles, co-pays, and total out-of-pocket costs. Affordable marketplace insurance options NH may have slightly higher premiums but save you money in the long run.

7. Not Updating Your Information

Your circumstances may change during the year. If your income or household size changes, report it to the marketplace. This ensures your financial assistance options for NH Marketplace coverage are accurate.

Quick Tips to Avoid Mistakes

- Compare NH individual health insurance plans carefully

- Apply for subsidies and premium tax credits

- Check networks and prescription coverage

- Review your plan each year during open enrollment health insurance NH

By avoiding these common mistakes, you’ll make the NH health insurance marketplace work for you. You’ll get the protection, savings, and peace of mind you deserve — without surprises or regrets.

Frequently Asked Questions About NH Health Insurance Marketplace

Here are the most common questions people in New Hampshire have about the NH health insurance marketplace. Reading this will make your choices easier and give you confidence when signing up.

1. How do I apply for health insurance marketplace in NH?

You apply online at the HealthCare.gov marketplace, New Hampshire’s federally facilitated marketplace. Enter your household info, income, and preferences to see NH individual health insurance plans. You can compare costs, coverage, and check for health insurance subsidies or premium tax credits.

2. When does open enrollment start and end in NH?

Open enrollment health insurance NH usually happens once a year. During this period, anyone can enroll in qualified health plans. If you miss it, you can still apply during a special enrollment period for life events like marriage, a new baby, or job loss.

3. Do I qualify for Marketplace tax credits in NH?

Most people earning between 100% and 400% of the federal poverty level qualify. When you apply, the Marketplace financial help NH is calculated automatically. You could get affordable marketplace insurance options NH that lower your monthly costs.

4. What are the best NH marketplace health insurance plans for families?

It depends on your needs. Families usually look at Silver or Gold plans because they balance premiums and out-of-pocket costs. Compare top Marketplace insurers in New Hampshire and use health insurance comparison NH tools to find the best fit.

5. Are there Marketplace coverage options for self-employed in NH?

Yes! If you are self-employed, freelance, or work gig jobs, there are specific plans for you. You can also qualify for financial assistance options for NH Marketplace coverage to make premiums more affordable.

6. What happens if I miss open enrollment?

You can only enroll outside of open enrollment if you have a qualifying life event. Otherwise, you’ll need to wait until the next open enrollment health insurance NH period.

7. How do subsidies and premium tax credits work?

When you apply, the system checks your income and household size. Eligible applicants receive health insurance subsidies and premium tax credits, reducing their monthly payments. This ensures affordable marketplace insurance options NH are available for most residents.

8. Can I keep my doctor?

Yes, but always check if your doctor is in-network when comparing NH individual health insurance plans. Using health insurance comparison NH helps avoid surprises.