Discover the best Ohio health insurance plans in 2025. Compare costs, coverage, and options for families, seniors, and individuals. Learn how to get affordable health insurance in Ohio and choose the right plan today.

What Is Health Insurance and Why It Matters in Ohio

If you live in Ohio, chances are you’ve heard people talk about Ohio health insurance, but many still feel confused about what it really means. Don’t worry—you’re not alone. Let’s break it down in the simplest way possible.

Health insurance is like a safety net for your health and your wallet. When you have health insurance in Ohio, your insurance company helps pay for doctor visits, hospital stays, medicines, and emergency care. Instead of paying 100% of the bill yourself, you share the cost. That can save you thousands of dollars when you need care the most.

Now here’s why Ohio health insurance plans matter so much.

In Ohio, medical costs can add up fast. A simple emergency room visit can cost more than $1,000, and a hospital stay can reach $10,000 or more. Without health insurance Ohio, those bills come straight out of your pocket. That kind of stress can keep people awake at night.

With the right Ohio health insurance coverage, you can:

- Visit a doctor without fear

- Get medicine when you’re sick

- Protect your family from big medical bills

- Feel peace of mind every day

Many people think Ohio health insurance cost is always too high, but that’s not true. There are affordable health insurance in Ohio options for families, single adults, seniors, and even people with low income. Programs like the Ohio health insurance marketplace and Medicaid help make coverage more affordable than most people expect.

Another reason Ohio health insurance options are important is timing. Life happens. Accidents, illnesses, and surprises don’t wait for the “right moment.” Having Ohio health insurance plans means you’re ready when life throws a curveball.

Whether you’re looking for health insurance plans Ohio 2025, trying to compare Ohio health insurance plans, or simply want to understand how coverage works, learning the basics puts you in control. Knowledge helps you make smart choices—for yourself and the people you love.

In short, best health insurance in Ohio isn’t just about policies and paperwork. It’s about feeling safe, protected, and confident that help is there when you need it.

And that peace of mind? That’s priceless.

Overview of the Ohio Health Insurance System

Before choosing any plan, it helps to understand how the Ohio health insurance system works. Once you see the big picture, everything becomes much easier—and far less scary.

In Ohio, Ohio health insurance works under rules set by both the federal government and the state. This means there are clear protections for people who buy health insurance in Ohio. Companies cannot deny you coverage just because you were sick before. That’s a huge relief for many families.

At the center of the system is the Ohio health insurance marketplace. This is an official place where people can shop for Ohio health insurance plans online. Think of it like a trusted store where you can compare Ohio health insurance plans side by side—prices, coverage, and benefits—all in one place.

There are also private Ohio health insurance companies that sell plans directly. These companies must follow Ohio laws to make sure plans are fair and reliable. This protects you from hidden tricks and unfair pricing.

One important thing to know is that health insurance Ohio is designed for different life situations. That’s why you’ll see many Ohio health insurance options, such as:

- Plans for families

- Plans for single adults

- Plans for seniors

- Plans for people with lower income

If you qualify, programs like Medicaid can offer affordable health insurance in Ohio with very low or even zero monthly cost. For others, marketplace plans can lower the Ohio health insurance cost using financial help called subsidies.

What makes the system strong is choice. You are not forced into one plan. You can review Ohio health insurance reviews, check benefits, and pick what fits your needs and budget. This freedom helps people feel confident instead of trapped.

Many people searching for best health insurance in Ohio feel overwhelmed at first. That’s normal. But the system is built to guide you step by step. Once you understand how it works, finding the right Ohio health insurance coverage becomes much simpler.

In short, the Ohio health insurance system exists to protect your health, your money, and your peace of mind. When you understand the system, you stop guessing—and start making smart choices.

Types of Health Insurance Plans Available in Ohio

When people search for Ohio health insurance, they often feel confused because there are many types of plans. The good news? Each plan exists for a reason, and once you understand them, choosing becomes much easier.

Let’s walk through the main Ohio health insurance options in simple words.

Employer-Sponsored Health Insurance in Ohio

This is the most common type of health insurance in Ohio. If you work full-time, your employer may offer insurance as part of your job.

Here’s why many people like it:

- Your job pays part of the cost

- Monthly payments are usually lower

- Coverage is often strong

Still, you don’t always get many choices. If the plan doesn’t fit your family needs, you may need to explore other Ohio health insurance plans.

Individual and Family Health Insurance Plans

If you’re self-employed, unemployed, or your job doesn’t offer coverage, this option is for you. These plans are bought directly through private companies or the Ohio health insurance marketplace.

People choose these plans because:

- They offer flexibility

- You can compare benefits

- You can control your Ohio health insurance cost

Many families find affordable health insurance in Ohio this way, especially with financial help.

Ohio Health Insurance Marketplace (ACA Plans)

The Ohio health insurance marketplace is an official website where you can shop safely. It allows you to compare Ohio health insurance plans by price, coverage, and benefits.

Plans are grouped into levels:

- Bronze (lower monthly cost)

- Silver (balanced option)

- Gold (higher coverage)

- Platinum (highest coverage)

Most people looking for best health insurance in Ohio start here.

Medicaid Health Insurance in Ohio

Medicaid offers Ohio health insurance coverage to people with low income. Many children, seniors, and adults qualify.

Benefits include:

- Very low cost

- Doctor visits

- Hospital care

- Prescriptions

This is one of the most trusted Ohio health insurance options for families who qualify.

Medicare and Medicare Advantage Plans in Ohio

If you are 65 or older, Medicare is a key part of health insurance Ohio. It helps cover hospital stays, doctor visits, and more.

Some people choose Medicare Advantage plans for added benefits like dental and vision care.

Short-Term Health Insurance Plans

These plans offer temporary coverage. They may help during job changes but usually offer limited protection. They are not ideal for long-term Ohio health insurance coverage.

Each plan fits a different life stage. Understanding these choices helps you move closer to the best health insurance in Ohio—for you and your loved ones.

Health Insurance Plan Types Explained (HMO, PPO, EPO, and POS)

When choosing Ohio health insurance, many people get stuck on confusing letters like HMO or PPO. Don’t worry—these are much simpler than they sound. Let’s explain them like everyday life choices.

Understanding these plan types helps you pick the best health insurance in Ohio without stress.

HMO Plans (Health Maintenance Organization)

An HMO plan is a budget-friendly option for health insurance in Ohio.

How it works:

- You choose one main doctor

- That doctor sends you to specialists

- You must stay in the plan’s network

Why people choose it:

- Lower monthly payments

- Predictable costs

- Good for families who like structure

HMO plans are often part of affordable health insurance in Ohio, especially on the Ohio health insurance marketplace.

PPO Plans (Preferred Provider Organization)

PPO plans give you more freedom. With a PPO, you can visit doctors without referrals.

Why people like PPOs:

- More doctor choices

- No referrals needed

- Easier access to specialists

The trade-off? Higher Ohio health insurance cost. Still, many people feel the flexibility is worth it when comparing Ohio health insurance plans.

EPO Plans (Exclusive Provider Organization)

An EPO plan is a mix between HMO and PPO.

Key points:

- No referrals needed

- Must stay in-network

- Lower cost than PPO

EPOs are popular for people who want balance when choosing Ohio health insurance options.

POS Plans (Point of Service)

POS plans combine features from both HMO and PPO plans.

What makes them different:

- You choose a main doctor

- Referrals are needed

- You can see out-of-network doctors (at higher cost)

They offer flexibility but can increase Ohio health insurance cost if used often.

Which Plan Type Is Best for You?

There’s no one-size-fits-all answer. The best health insurance in Ohio depends on:

- Your budget

- Your doctors

- Your health needs

When you compare Ohio health insurance plans, always check networks, flexibility, and coverage—not just price.

Choosing the right plan type helps you avoid surprises and gives you confidence in your Ohio health insurance coverage.

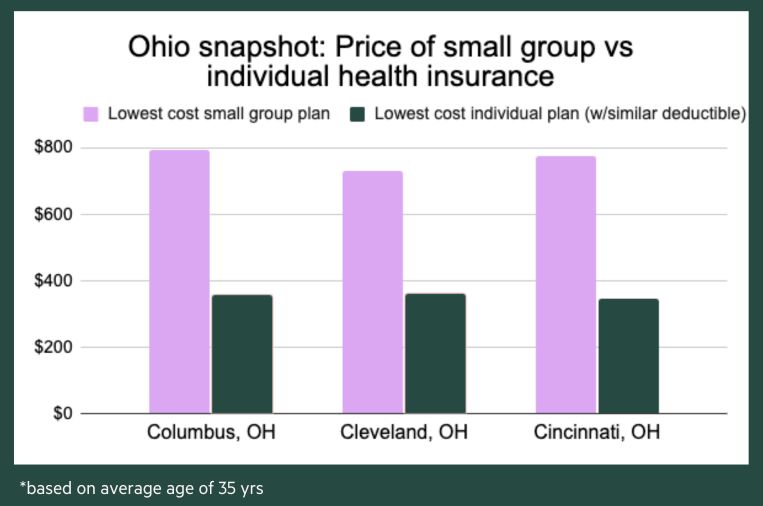

How Much Does Health Insurance Cost in Ohio?

One of the first questions people ask when searching for Ohio health insurance is: “How much will this actually cost me?” Let’s break it down in simple terms.

The Ohio health insurance cost depends on several factors, but the good news is there are affordable health insurance in Ohio options for most people.

1. Plan Type Matters

Different plans come with different prices:

- HMO: Usually the cheapest, great for families who stay in-network.

- PPO: Higher Ohio health insurance cost, but more freedom to choose doctors.

- EPO: Moderate cost, balance of network rules and flexibility.

- POS: Flexible but can get expensive if you go out-of-network a lot.

2. Your Age and Health

Young and healthy adults often pay less, while older adults may pay more. Your personal health history can also affect the cost, especially if you need prescriptions or frequent doctor visits.

3. Coverage Level

On the Ohio health insurance marketplace, plans are grouped by metal tiers:

- Bronze: Low monthly payment, higher out-of-pocket costs

- Silver: Moderate monthly cost, balanced coverage

- Gold: Higher premium, lower costs when visiting doctors

- Platinum: Highest monthly cost, lowest out-of-pocket

Most people looking for best health insurance in Ohio choose Silver for balance.

4. Family Size

Adding children or dependents increases your Ohio health insurance coverage cost. But programs like Medicaid or subsidies can help lower the monthly expense for eligible families.

5. Location and Provider Network

Even within Ohio, costs can vary depending on where you live. Larger cities might have more options, but the prices could be slightly higher. Always check which doctors and hospitals are included in Ohio health insurance plans.

6. Extra Costs to Consider

Besides your monthly premium, remember:

- Deductibles: Amount you pay before insurance kicks in

- Copays: Fixed fee for visits or prescriptions

- Coinsurance: Your share of costs after deductible

Understanding these helps you avoid surprises and plan your budget wisely.

Summary

The Ohio health insurance cost may seem confusing, but breaking it down makes it manageable. By comparing Ohio health insurance plans and looking at affordable health insurance in Ohio, you can find coverage that fits your budget and protects your family.

Having Ohio health insurance coverage isn’t just about money—it’s about peace of mind. Knowing that you and your loved ones are protected from unexpected medical bills is priceless.

Hidden Health Insurance Costs People in Ohio Overlook

When people think about Ohio health insurance, most focus only on the monthly payment. But here’s a little secret—there are hidden costs that can sneak up on you. Understanding these is key to choosing the best health insurance in Ohio.

1. Deductibles

Your deductible is the amount you pay out of your pocket before your insurance starts covering costs. For example, if your deductible is $1,500, you’ll pay that first for doctor visits, tests, or hospital stays. Even with Ohio health insurance coverage, this is something you need to plan for.

2. Copays

A copay is a small fixed fee for each doctor visit or prescription. It may be $20 for a check-up or $10 for a medication. On top of your monthly plan payment, these can add up, especially if you visit multiple doctors or specialists.

3. Coinsurance

Coinsurance is your share of costs after your deductible is met. For example, if your plan covers 80% of a $500 procedure, you pay 20%, which is $100. People often forget this cost when comparing Ohio health insurance plans.

4. Out-of-Pocket Maximums

Every plan has an out-of-pocket maximum, the most you’ll pay in a year. Once you hit that limit, your insurance covers 100% of costs. Knowing this number is important—it protects you from unexpectedly high bills.

5. Prescription Drug Costs

Even with Ohio health insurance coverage, medications can be expensive. Plans categorize drugs into tiers, and lower-tier drugs usually cost less. Make sure your medicines are covered in your plan to avoid surprises.

6. Specialty Care or Emergency Visits

Specialists, ER visits, or out-of-network providers can increase your Ohio health insurance cost. Always check if your doctors and hospitals are included in Ohio health insurance plans to save money.

Summary

Hidden costs are a big reason people feel overwhelmed when looking for Ohio health insurance plans. But knowing about deductibles, copays, coinsurance, and other hidden expenses helps you make smart choices. It ensures your coverage really protects your health and your wallet.

When you shop for affordable health insurance in Ohio, don’t just look at the monthly premium. Look deeper—this is how you find the best health insurance in Ohio for your life and budget.

How to Choose the Best Health Insurance Plan in Ohio

Choosing Ohio health insurance can feel like a maze, but don’t worry—you don’t need a map if you know the right steps. Let’s make it simple and practical so you can pick the best health insurance in Ohio for you and your family.

1. Know Your Needs

Start by asking yourself:

- Who needs coverage? You, your kids, spouse?

- Do you have regular doctor visits or prescriptions?

- Are you planning for emergencies or long-term care?

Answering these questions helps you compare Ohio health insurance plans effectively.

2. Compare Plan Types

Remember Section 4? You now know about HMO, PPO, EPO, and POS. Check:

- Which doctors you want to see

- How flexible you need your plan

- How much you’re willing to pay

This makes choosing Ohio health insurance coverage much easier.

3. Look at Costs Closely

Don’t just look at the monthly payment. Consider:

- Deductibles and copays

- Coinsurance

- Prescription costs

- Out-of-pocket maximums

By understanding all the hidden expenses, you’ll avoid surprises with your Ohio health insurance cost.

4. Check Provider Networks

If you have a favorite doctor or hospital, make sure they are included in your Ohio health insurance plans. Choosing a plan outside your network can increase costs and stress.

5. Explore Financial Assistance

Many Ohio residents qualify for help. Check if you’re eligible for:

- Medicaid

- Marketplace subsidies

- Cost-sharing reductions

These options make affordable health insurance in Ohio truly affordable.

6. Read Reviews and Ratings

Look at Ohio health insurance reviews from other people. Their experiences can tell you a lot about customer service, claim support, and plan reliability.

7. Make a Checklist

Before buying a plan, make a small checklist:

- Coverage for all family members

- Affordable Ohio health insurance cost

- Doctors included in network

- Prescription coverage

- Financial assistance eligibility

Checking each box ensures you choose the best health insurance in Ohio confidently.

Summary

Finding the right Ohio health insurance coverage isn’t about luck—it’s about knowing what you need, comparing your options, and understanding the real costs. When you follow these steps, you can pick a plan that protects your health, your family, and your wallet.

Peace of mind starts with Ohio health insurance plans that fit your life perfectly.

Enrollment Periods for Ohio Health Insurance

One of the most important things to know about Ohio health insurance is when you can sign up. Missing the right period can leave you without coverage, so let’s make it simple.

1. Open Enrollment

Open enrollment is the main time each year to enroll in or change your Ohio health insurance plans.

- Usually happens once a year (October through December for marketplace plans)

- You can compare Ohio health insurance plans and pick the best health insurance in Ohio for your needs

Think of it as the annual “health insurance shopping season”—don’t miss it!

2. Special Enrollment Periods

Life doesn’t always wait for open enrollment. That’s why Ohio health insurance has special enrollment periods when you can sign up outside the usual dates. Examples include:

- Losing job-based coverage

- Getting married

- Having a baby

- Moving to Ohio or within Ohio

If you qualify, you can get Ohio health insurance coverage immediately—no waiting for next year.

3. Employer-Sponsored Plans Enrollment

If your employer offers health insurance in Ohio, they also have a specific enrollment period, usually at the start of the plan year.

- Check with HR for exact dates

- You can also make changes during qualifying events like marriage or childbirth

This is a great opportunity to review Ohio health insurance options and pick the plan that fits your life.

4. Why Timing Matters

Even if you know the best health insurance in Ohio, signing up at the wrong time can leave you exposed to big medical bills. By understanding Ohio health insurance cost, coverage levels, and enrollment periods, you stay protected year-round.

Summary

Knowing the right Ohio health insurance enrollment periods is key to getting coverage without hassle. Whether it’s open enrollment, a special enrollment period, or employer enrollment, being prepared ensures your family is protected. When you plan ahead, choosing Ohio health insurance plans becomes simple, stress-free, and smart.

Financial Assistance & Subsidies for Ohio Residents

Paying for Ohio health insurance can feel overwhelming, but there’s good news. Many residents qualify for financial assistance that makes affordable health insurance in Ohio possible. Let’s break it down.

1. Premium Tax Credits

These are discounts that lower your monthly payment for Ohio health insurance plans purchased through the Ohio health insurance marketplace.

- You may qualify if your income is within a certain range

- Helps reduce your Ohio health insurance cost significantly

This means you can get the best health insurance in Ohio without emptying your wallet.

2. Cost-Sharing Reductions

Cost-sharing reductions lower the amount you pay when visiting doctors or getting care.

- Deductibles, copays, and coinsurance are reduced

- Only available for certain Ohio health insurance plans on the marketplace

This is perfect for families or anyone worried about out-of-pocket costs.

3. Medicaid Expansion in Ohio

Ohio expanded Medicaid to cover more adults, which is a huge help for those with low income.

- Offers Ohio health insurance coverage with very low or no monthly payment

- Includes doctor visits, prescriptions, hospital stays, and preventive care

If you qualify, this is one of the most reliable Ohio health insurance options.

4. Employer Assistance

Some employers provide financial support for health insurance in Ohio.

- They pay a portion of the premium

- Reduces your Ohio health insurance cost even if you choose a more comprehensive plan

This is another way to find affordable health insurance in Ohio.

5. How to Check Eligibility

You can check eligibility for all these programs:

- Visit the Ohio health insurance marketplace

- Use official state resources for Medicaid

- Talk to your HR or benefits department

Doing this helps you find Ohio health insurance plans that fit your budget and needs.

Summary

Financial assistance can make a big difference. By exploring premium tax credits, cost-sharing reductions, Medicaid, and employer help, you can reduce your Ohio health insurance cost while still getting full coverage. These tools make best health insurance in Ohio more accessible than many people realize.

Peace of mind is priceless, and these programs ensure your health and your wallet are protected.

Common Health Insurance Mistakes Ohio Residents Make

Even after learning about Ohio health insurance, many people make mistakes that can cost them money or coverage. Let’s highlight these so you can avoid them when choosing the best health insurance in Ohio.

1. Choosing the Cheapest Plan Without Checking Coverage

A low monthly payment is tempting, but it doesn’t always cover what you need. Some Ohio health insurance plans may have high deductibles or limited provider networks. Always check:

- Which doctors are included

- What services are covered

- Prescription coverage

Skipping this step can turn an “affordable” plan into an expensive surprise.

2. Ignoring the Provider Network

Not all doctors and hospitals accept every plan. Many Ohio residents forget to verify the network and end up paying more. Always review Ohio health insurance coverage carefully before enrolling.

3. Forgetting About Hidden Costs

Monthly premiums are just part of the total cost. Remember:

- Deductibles

- Copays

- Coinsurance

- Prescription costs

These hidden expenses affect your Ohio health insurance cost, so don’t ignore them.

4. Missing Enrollment Deadlines

Signing up too late can leave you without coverage. Keep track of:

- Open enrollment

- Special enrollment periods

Being aware ensures your Ohio health insurance coverage is continuous and reliable.

5. Not Exploring Financial Assistance

Many people don’t check if they qualify for:

- Medicaid

- Marketplace subsidies

- Employer support

Missing out means paying more than necessary for affordable health insurance in Ohio.

6. Choosing a Plan Without Reading Reviews

Checking Ohio health insurance reviews helps you understand customer experiences, claim processes, and plan reliability. Ignoring reviews can lead to frustration later.

Summary

Avoiding these mistakes helps you find the best health insurance in Ohio that truly fits your needs. Take your time to review costs, networks, and coverage, check deadlines, and explore all financial assistance options. A little planning today can save money and stress tomorrow.

Trusted Ohio Health Insurance Resources

When looking for Ohio health insurance, it’s important to get information from reliable sources. The right guidance can save you money, prevent mistakes, and help you find the best health insurance in Ohio for your family.

1. Ohio Department of Insurance

The Ohio Department of Insurance is the official state office overseeing health insurance in Ohio.

- Provides consumer guides

- Offers information on insurance rules and rights

- Can help resolve disputes with Ohio health insurance companies

Checking their resources ensures you get accurate and trustworthy information.

2. Ohio Health Insurance Marketplace (Healthcare.gov)

The Ohio health insurance marketplace is the safest place to shop for ACA plans.

- Compare Ohio health insurance plans

- See Ohio health insurance cost clearly

- Apply for financial assistance and subsidies

It’s user-friendly and designed to make enrollment simple, even for first-timers.

3. Medicaid Ohio

Medicaid is a government program providing Ohio health insurance coverage for low-income residents.

- Check eligibility online

- Learn about covered services

- Apply directly through official state portals

Medicaid ensures that affordable health insurance is accessible for those who need it most.

4. Employer HR Departments

If you have health insurance in Ohio through your job, your HR or benefits department is a great resource.

- They explain plan options

- Help with enrollment periods

- Provide guidance on Ohio health insurance cost and coverage

This can make your plan selection easier and more accurate.

5. Online Reviews and Trusted Sites

Websites that offer Ohio health insurance reviews can help you compare companies, coverage options, and customer service experiences. Reading reviews helps you choose a plan that suits your needs and avoids surprises.

Summary

Using trusted resources makes finding the best health insurance in Ohio much simpler. Whether it’s official state websites, the Ohio health insurance marketplace, Medicaid, or employer guidance, relying on accurate information ensures you get coverage that protects both your health and your wallet.

Frequently Asked Questions About Ohio Health Insurance

If you’re searching for Ohio health insurance, chances are you have questions. Let’s answer some of the most common ones so you can make smart choices and feel confident about your coverage.

1. Can I get low-cost health insurance in Ohio?

Yes! Many residents qualify for affordable health insurance in Ohio through programs like Medicaid or marketplace subsidies. By comparing Ohio health insurance plans, you can find options that fit your budget without sacrificing coverage.

2. What is the best plan for families?

The best health insurance in Ohio for families usually offers a good balance between cost and coverage. Look for:

- Low deductibles

- Comprehensive coverage for children

- Flexible provider networks

Marketplace plans, employer-sponsored plans, and Medicaid are all worth considering depending on your family’s needs.

3. Is Medicaid better than marketplace insurance?

It depends on your situation. Medicaid offers low-cost Ohio health insurance coverage for eligible families, while marketplace plans can be customized and may include subsidies. Comparing Ohio health insurance options is the best way to decide.

4. When can I enroll in Ohio health insurance?

You can enroll during:

- Open enrollment (once a year, usually October to December)

- Special enrollment periods triggered by events like moving, marriage, or having a baby

Missing these windows could delay your coverage, so always check enrollment dates when shopping for Ohio health insurance plans.

5. What affects Ohio health insurance cost?

Your Ohio health insurance cost depends on factors like:

- Age

- Plan type (HMO, PPO, EPO, POS)

- Family size

- Coverage level

Understanding these factors helps you choose the best health insurance in Ohio for your situation.

6. How do I choose the right plan?

Follow these steps:

- Assess your needs

- Compare plan types and costs

- Check provider networks

- Explore financial assistance

This ensures your Ohio health insurance coverage protects you and your family without overspending.

Summary

FAQs help clear confusion and guide you toward the best health insurance in Ohio. Knowing your options, costs, and enrollment periods makes selecting a plan easier, stress-free, and tailored to your life.

Final Thoughts: Finding the Right Ohio Health Insurance Plan

Choosing Ohio health insurance might seem complicated at first, but it doesn’t have to be. By understanding your options, costs, and enrollment periods, you can find the best health insurance in Ohio that truly fits your needs.

Why Ohio Health Insurance Matters

Health coverage isn’t just about paying bills—it’s about peace of mind. With Ohio health insurance coverage, you can:

- See doctors when you’re sick

- Get medications on time

- Protect your family from unexpected costs

Even simple things, like a routine check-up or prescription, are easier when you have reliable coverage.

Tips for Choosing Wisely

- Know your needs: Who in your family needs coverage? Do you have ongoing medical care?

- Compare plans: Look at HMO, PPO, EPO, and POS options. Check networks, benefits, and costs.

- Check financial help: Explore affordable health insurance in Ohio, Medicaid, and marketplace subsidies.

- Watch hidden costs: Consider deductibles, copays, coinsurance, and out-of-pocket maximums.

By following these steps, you increase your chances of picking the best health insurance in Ohio without surprises.

Why Knowledge is Power

When you understand Ohio health insurance plans, you make confident decisions. You can compare Ohio health insurance plans, check costs, and choose coverage that fits your lifestyle. No guessing, no stress—just clear, smart choices.

Take Action Today

Don’t wait until it’s too late. Whether it’s open enrollment or a special enrollment period, acting now ensures your Ohio health insurance coverage protects you and your loved ones.

Remember, the best health insurance in Ohio is the one that keeps you healthy, secure, and worry-free.

Summary

Finding the right Ohio health insurance is about preparation, knowledge, and careful comparison. Use trusted resources, understand costs, and explore your options. With these tools, you can confidently select the best health insurance in Ohio for yourself and your family—and enjoy the peace of mind that comes with it.