Learn what level funded health insurance is, how it works, and why US small businesses choose it for predictable costs and possible savings.

What Is Level Funded Health Insurance?

If you’ve ever felt confused by health insurance options, you’re not alone. Many business owners ask the same question: what is level funded health insurance, and how is it different from traditional plans? Let’s break it down in the simplest way possible—no complicated terms, no insurance talk overload.

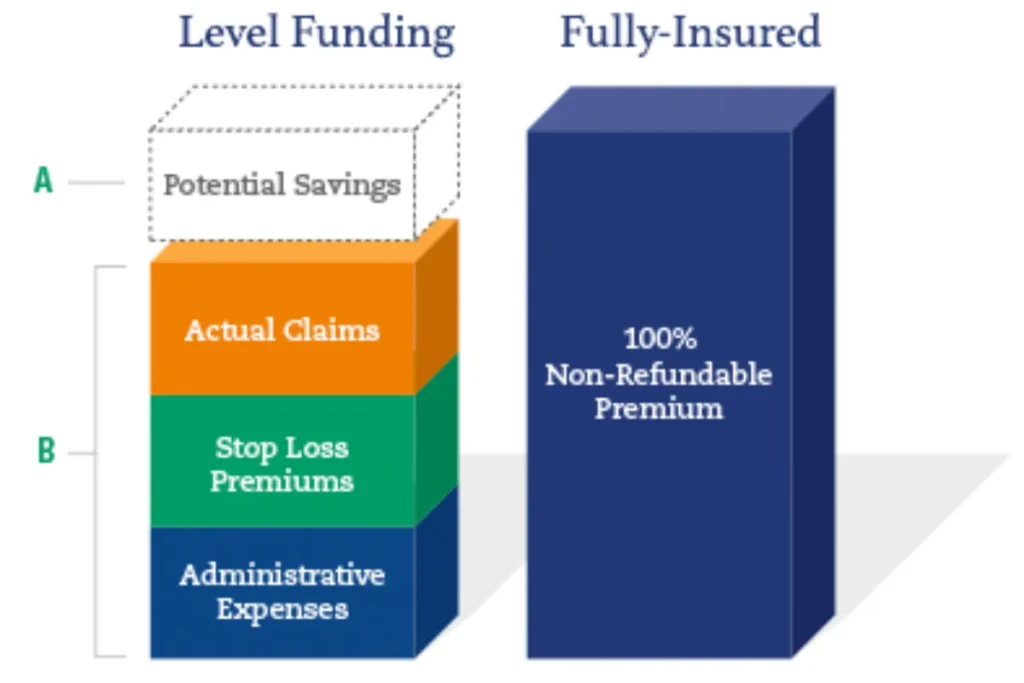

Level funded health insurance is a smart, middle-ground option between fully insured and self-funded health plans. Think of it like this: instead of paying a high, fixed premium every month (like traditional insurance), you pay a predictable monthly amount that covers three things—employee claims, administrative costs, and stop-loss protection. That’s it. Simple and clear.

Here’s what makes level funded health insurance explained easy to understand:

You pay the same monthly amount all year long, so there are no surprise bills. That’s why many people ask, how does level funded health insurance work for small businesses? It works by giving employers cost control while limiting risk.

Let’s use a real-life example. Imagine you own a small business with 25 employees. With traditional fully insured health insurance, you pay high premiums no matter how healthy your team is. But with level funded health plans, if your employees don’t use much healthcare during the year, you may get money back at the end. Yes—refunds are possible, which is why many employers find this option exciting and emotionally reassuring.

Now you might wonder, is this the same as self-funding? Not exactly. Level funded vs fully insured plans sit right in the middle. You get the savings potential of self-funded plans but with stop-loss insurance that protects you if claims get too high. That safety net makes level funded health insurance for small businesses feel much safer and less stressful.

Another reason people love this option is transparency. With level funded health insurance plans, you can actually see where your money goes. That clarity builds trust and confidence—two things every business owner wants.

In short, what is level funded health insurance really about?

It’s about control, predictability, and peace of mind. You know what you’ll pay each month. You may save money. And you’re protected if something unexpected happens.

If you’re tired of rising healthcare costs and want a smarter, friendlier option, level funded health insurance could be the fresh start your business needs.

How Does Level Funded Health Insurance Work? (Step by Step)

Now that you understand what is level funded health insurance, let’s look at how does level funded health insurance work in real life. Don’t worry—this part is simple, friendly, and easy to follow. Think of it like breaking a big puzzle into small, clear pieces.

Step 1: You pay a fixed monthly amount

With level funded health insurance, you pay the same amount every month. This is called a level payment, and it makes budgeting much easier. No guessing. No sudden price jumps. Many employers choose level funded health plans because they like knowing exactly what they’ll pay all year long.

Step 2: Your payment is split into three parts

Each monthly payment is divided into:

- Claims fund – money set aside to pay employee medical bills

- Administrative costs – plan management and customer support

- Stop-loss insurance – protection if claims get too high

This setup explains level funded health insurance explained in the simplest way—your risk is limited, and your costs stay steady.

Step 3: Employee claims are paid from the claims fund

When employees visit a doctor or get care, the cost comes from the claims fund. If your team stays healthy, that fund doesn’t get used much. This is why many people ask if level funded health insurance for small businesses can save money—and the answer is yes, in many cases.

Step 4: Stop-loss protection keeps you safe

Here’s where peace of mind kicks in. If claims suddenly rise, stop-loss insurance steps in. You’re protected from large, unexpected bills. This is what makes level funded vs fully insured plans feel less risky than self-funded options.

Step 5: You may get a refund at the end of the year

If there’s money left in the claims fund, you may receive a refund. That’s one of the biggest emotional wins of level funded health insurance plans—you don’t lose unused money like you do with traditional insurance.

So, how does level funded health insurance work overall?

It gives you predictable costs, built-in protection, and a chance to save money—all while keeping things simple and stress-free.

Is Level Funded Health Insurance Fully Insured or Self-Funded?

This is one of the most common questions people ask after learning what is level funded health insurance. So let’s clear it up in the easiest way possible—no confusing terms, no complicated charts.

The short answer is this: level funded health insurance is both and neither at the same time. It’s a hybrid plan, which means it sits right in the middle of fully insured and self-funded health insurance.

Let’s start with fully insured plans. In a fully insured plan, you pay a high fixed premium every month. No matter how healthy or unhealthy your employees are, that money is gone. You never see it again. That’s why many business owners feel frustrated and ask if there’s a better option than traditional insurance.

Now let’s talk about self-funded plans. With self-funding, the employer pays medical claims directly. This can save money, but it also brings stress. One bad year with high claims can hurt your budget. That risk is why many small businesses avoid self-funding.

This is where level funded health insurance explained really shines.

With level funded health plans, you still make predictable monthly payments, just like fully insured plans. That feels safe and easy. But unlike fully insured plans, your money goes into a claims fund. If claims are low, you may get a refund. That’s a big emotional win.

At the same time, stop-loss insurance protects you from high claims. This is what makes level funded vs fully insured plans safer than self-funded options. Your risk is capped, so you’re not exposed to scary surprise costs.

So if you’re wondering whether level funded health insurance for small businesses feels more like fully insured or self-funded, here’s the simple truth:

- Like fully insured → predictable monthly costs

- Like self-funded → potential savings and transparency

- Better than both → built-in protection and control

In the end, what is level funded health insurance really about choice. It gives employers the comfort of stability with the excitement of possible savings—without taking on too much risk.

Who Is Level Funded Health Insurance Best For?

Now that you clearly understand what is level funded health insurance, the next big question is simple and important: Is this the right fit for you? The answer depends on your business size, goals, and how much control you want over healthcare costs.

Level funded health insurance is best for small to mid-sized businesses, especially those with 10 to 100 employees. If your company falls into this range, this option can feel like a breath of fresh air. It gives you structure, savings potential, and peace of mind—all at the same time.

This type of plan works especially well for businesses with a stable and fairly healthy workforce. If your employees don’t visit the doctor often, level funded health plans can reward you for that. Less spending on claims may lead to money back at the end of the year, which feels empowering and motivating for any employer.

Business owners who love predictable monthly costs are also a great match. With level funded health insurance explained, you pay the same amount each month, making budgeting easier and stress-free. No surprises. No panic. Just clarity.

If you’ve been frustrated with rising premiums under traditional insurance, level funded vs fully insured plans can feel like a smarter move. Instead of watching your money disappear, you finally get insight into where it goes. That transparency builds confidence and trust.

Level funded health insurance for small businesses is also ideal for owners who want some control, but not full risk. You don’t want to gamble with self-funding, and that’s okay. Stop-loss protection keeps you safe, so you’re never exposed to large, scary claims.

However, this option may not be perfect for everyone. Very small groups or businesses with frequent high medical claims may not qualify. Still, for many growing companies, level funded health insurance offers a balanced, emotionally reassuring solution.

In simple words, if you want control, stability, and a chance to save, this plan might be exactly what your business needs.

Pros and Cons of Level Funded Health Insurance

Before choosing any health plan, it’s natural to ask, “What’s good about it—and what should I watch out for?” Let’s walk through the pros and cons of level funded health insurance in a clear, honest, and easy way, so you can feel confident and informed.

Pros of Level Funded Health Insurance

1. Predictable monthly costs

One of the biggest emotional wins of level funded health insurance is peace of mind. You pay the same amount every month, which makes budgeting simple and stress-free. No scary surprises.

2. Possible refunds at the end of the year

Unlike traditional plans, level funded health plans don’t automatically keep unused money. If employee claims are low, you may get a refund. That feels rewarding—almost like getting money back for making a smart choice.

3. Lower costs than fully insured plans

Many employers find that level funded vs fully insured plans cost less over time. You’re not overpaying just to cover worst-case scenarios.

4. Built-in protection with stop-loss insurance

You’re never alone if claims rise. Stop-loss coverage steps in and protects you, which makes level funded health insurance explained much safer than full self-funding.

5. Clear visibility into spending

You can actually see where your money goes. That transparency builds trust and helps you make better decisions for your business and employees.

Cons of Level Funded Health Insurance

1. Medical underwriting is required

Not every business qualifies. Companies with very high or unpredictable claims may not be approved. This is important to know upfront.

2. Refunds are not guaranteed

While refunds are possible, they don’t happen every year. If claims are high, there may be no money left to return.

3. Not ideal for very small groups

Businesses with fewer than 10 employees may have limited options when it comes to level funded health insurance for small businesses.

The Bottom Line

So, is level funded health insurance worth it?

For many employers, the answer is yes—because it offers control, predictability, and a real chance to save money, all while keeping risk low.

Understanding both the good and the not-so-good helps you make a choice that feels right, confident, and empowering.

Level Funded Health Insurance vs Fully Insured Plans

If you’re trying to choose between options, this comparison really matters. Let’s clearly compare level funded health insurance and fully insured health plans in a simple, side-by-side way—so you can feel confident about your decision.

Cost predictability

Both options offer predictable monthly payments, which is great for budgeting. But here’s the key difference: with fully insured plans, you pay a fixed premium and that money is gone forever. With level funded health insurance, your monthly payment is also steady—but part of it goes into a claims fund that you might get back.

Potential savings

This is where emotions kick in. Fully insured plans don’t reward you for having a healthy team. Even if employees barely use healthcare, you still pay the same high rate. In contrast, level funded vs fully insured plans can feel more fair. If claims are low, you may receive a refund. That possibility alone makes many employers feel hopeful and motivated.

Risk level

Fully insured plans feel safe because the insurance company takes all the risk. But you pay for that safety with higher premiums. With level funded health plans, risk is shared—but capped. Thanks to stop-loss coverage, you’re protected from large claims. This balance is why level funded health insurance explained often sounds like the best of both worlds.

Transparency and control

Fully insured plans offer very little insight into where your money goes. It can feel frustrating and out of your hands. Level funded health insurance for small businesses offers more transparency. You can see claims data and understand spending, which helps you make smarter choices over time.

Who each option is best for

- Fully insured plans → businesses that want zero involvement

- Level funded health insurance → businesses that want control, savings, and protection

Simple takeaway

If you want simplicity only, fully insured may work.

If you want simplicity plus savings and insight, level funded health insurance often feels like the smarter, more empowering option.

Common Myths About Level Funded Health Insurance

By now, you have a solid understanding of what is level funded health insurance, but like many smart options, it comes with a few myths. These misunderstandings often stop business owners from exploring something that could actually help them save money and feel more in control. Let’s clear the air—simply and honestly.

Myth 1: Level funded health insurance is too risky for small businesses

This is one of the biggest fears. The truth? Level funded health insurance is designed for small and mid-sized businesses. Stop-loss protection limits risk, so you’re not exposed to large, unexpected costs. That’s why level funded health insurance for small businesses is becoming more popular every year.

Myth 2: Refunds are guaranteed

It would be amazing if refunds happened every time—but that’s not how it works. With level funded health plans, refunds are possible, not promised. If employee claims are low, you may get money back. If claims are high, you won’t. Understanding this helps set honest expectations and builds trust.

Myth 3: Level funded plans are the same as self-funded plans

This is another common mix-up. While both offer savings potential, level funded health insurance explained includes built-in protection. Self-funded plans don’t offer the same safety net. That’s a huge difference, especially when comparing level funded vs fully insured and self-funded options.

Myth 4: These plans are only for very healthy employees

Health matters, but perfection isn’t required. Many businesses with average health profiles still qualify. Underwriting looks at the overall group, not just one person.

Myth 5: Level funded health insurance is too complicated

Actually, it’s often simpler than traditional insurance. Fixed monthly payments, clear breakdowns, and transparency make level funded health insurance easier to understand than most people expect.

Simple takeaway

Most fears around level funded health insurance come from misunderstanding. Once you know the facts, it becomes clear that this option is not scary—it’s balanced, protective, and empowering.

What Happens If Claims Are Higher Than Expected?

This is a very real and emotional concern for business owners—and a smart one. After learning what is level funded health insurance, many people ask, “What if something goes wrong?” Let’s answer that clearly and calmly.

With level funded health insurance, you are not left alone if claims rise. This is where stop-loss insurance plays a huge role. Think of stop-loss as a safety shield. It steps in when medical costs go beyond a certain limit, protecting your business from financial stress.

Here’s how it works in simple terms. Each level funded health plan comes with a maximum risk limit. If employee medical claims go higher than expected, stop-loss coverage covers the extra amount. That means you never pay more than what you agreed to upfront. This is why many employers feel safer choosing this option over self-funded plans.

This protection is what separates level funded health insurance explained from full self-funding. With self-funded insurance, high claims can hit your business hard. But with level funded vs fully insured plans, you still get cost control and protection.

Another comforting fact is that even in a high-claims year, your monthly payments stay the same. There are no surprise invoices or emergency payments. That stability helps you plan ahead and sleep better at night.

It’s also important to know that a high-claims year doesn’t mean failure. Many businesses have ups and downs. One tough year doesn’t erase the long-term value of level funded health insurance for small businesses.

Simple takeaway

If claims are higher than expected, you are protected. Stop-loss insurance caps your risk, keeps costs predictable, and removes fear from the equation. That’s what makes level funded health insurance feel steady, supportive, and business-friendly.

Is Level Funded Health Insurance Cheaper?

Let’s talk about the question every business owner cares about most: money. After understanding what is level funded health insurance, it’s natural to ask, “Is it actually cheaper?” The honest answer is—it can be, depending on your situation.

With level funded health insurance, you’re not paying extra “just in case” costs like you do with traditional plans. Fully insured plans often include padding to cover worst-case scenarios. That’s why premiums keep rising year after year. In comparison, level funded health plans are priced based on your group’s real risk, which can feel more fair and emotionally satisfying.

If your employees stay relatively healthy, the savings can be meaningful. Lower claims mean less money spent, and that can lead to a refund at the end of the year. That refund isn’t just about dollars—it’s about feeling rewarded for making a smart, thoughtful choice. This is a big reason why level funded health insurance for small businesses is gaining attention across the U.S.

However, it’s important to stay realistic. Level funded health insurance explained clearly shows that refunds are not guaranteed. In years with higher medical usage, you may not save money. Still, even in those years, your costs are capped and predictable. That stability alone has value.

When comparing level funded vs fully insured plans, many employers find that level funded options offer better long-term potential. You gain transparency, possible savings, and protection—all without taking on full risk like self-funded plans.

Simple takeaway

So, is level funded health insurance cheaper?

For many businesses, yes—especially those with stable teams and smart cost control goals. It’s not about chasing the lowest price. It’s about choosing a plan that feels fair, balanced, and financially empowering.

How Level Funded Health Insurance Affects Employees

When employers think about health insurance, it’s easy to focus only on costs. But here’s the good news—level funded health insurance doesn’t just help businesses. It also creates a better experience for employees, which matters more than ever.

First, let’s talk about coverage and care. From an employee’s point of view, level funded health insurance plans usually look and feel just like traditional insurance. Employees still visit doctors, use networks, and access benefits the same way. There’s no added confusion, stress, or extra paperwork.

Now here’s where things get even better. Because level funded health insurance explained offers transparency, employers can make smarter plan choices over time. That often leads to better benefits, lower out-of-pocket costs, or improved coverage options. Employees feel valued when their health plan actually meets their needs.

Another emotional benefit is stability. Employees don’t like sudden changes or rising premiums. With level funded health plans, predictable costs help employers avoid constant plan changes. That creates trust and peace of mind across the team.

Wellness also plays a role. When businesses understand claims data, they can promote healthier habits, wellness programs, and preventive care. Over time, this can mean fewer doctor visits, lower costs, and happier employees. It’s a win-win.

Employees also benefit from the employer’s financial protection. Because stop-loss insurance limits risk, businesses are less likely to cut benefits during tough years. This makes level funded health insurance for small businesses feel secure and reliable.

Simple takeaway

Level funded health insurance supports employees by offering familiar coverage, steady benefits, and thoughtful improvements over time. When employees feel protected and cared for, morale rises—and that’s good for everyone.

Frequently Asked Questions About Level Funded Health Insurance

By now, you have a clear idea of what is level funded health insurance, but a few common questions still pop up for many business owners. Let’s answer them in a simple, friendly way—no confusion, no pressure.

1. Is level funded health insurance ACA-compliant?

Yes. Most level funded health insurance plans follow Affordable Care Act (ACA) rules. That means they cover essential health benefits and meet federal requirements, giving both employers and employees peace of mind.

2. Can small businesses switch to level funded health insurance mid-year?

In most cases, no. Like traditional plans, level funded health insurance usually starts at renewal time. Planning ahead helps ensure a smooth switch with no disruptions.

3. How do refunds work with level funded health plans?

Refunds happen when employee claims are lower than expected. If there’s money left in the claims fund at the end of the year, it may be returned to the employer. Just remember—refunds are possible, not guaranteed. This is a key part of level funded health insurance explained.

4. Is level funded health insurance good for small businesses?

Absolutely. Level funded health insurance for small businesses is popular because it offers predictable costs, savings potential, and protection—all without the heavy risk of self-funding.

5. Does this type of insurance affect employee coverage?

No. Employees usually won’t notice a difference. They still access doctors, hospitals, and benefits the same way they would with traditional insurance.

Simple takeaway

If you’re looking for balance, clarity, and control, level funded health insurance answers many common concerns in a calm and practical way.

Final Thoughts – Is Level Funded Health Insurance Right for Your Business?

Choosing the right health plan can feel overwhelming. But now that you clearly understand what is level funded health insurance, the decision becomes much easier and more confident.

Level funded health insurance offers something many business owners have been searching for—balance. You get predictable monthly costs, protection from big surprises, and the chance to save money if your employees stay healthy. That mix of stability and opportunity feels empowering, especially when healthcare costs keep rising.

For many employers, especially growing companies, level funded health insurance for small businesses hits the sweet spot. It gives you more control than fully insured plans, but far less risk than self-funded options. You’re not gambling—you’re making a thoughtful, informed choice.

Another reason this option stands out is transparency. With level funded health insurance explained, you finally see where your money goes. That clarity helps you plan better, support employees more effectively, and feel confident in your decisions.

Of course, no plan is perfect for everyone. But if you want steady costs, possible refunds, and built-in protection, level funded health plans deserve serious consideration. When compared in a level funded vs fully insured scenario, many employers find this option more fair, flexible, and future-ready.

The bottom line

If you value control, peace of mind, and smart savings, level funded health insurance could be the right fit for your business.