Explore Wyoming health insurance options, compare affordable plans, understand coverage, and find the best insurance providers in Wyoming for 2025.

Introduction to Wyoming Health Insurance

Choosing Wyoming health insurance can feel confusing, especially when you’re trying to make the best decision for yourself or your family. If you’ve ever opened a health insurance website and felt your heart drop, don’t worry — you’re not alone. A lot of people in Wyoming struggle to understand what plans mean, what they cover, and how much they actually cost. That’s exactly why this guide exists: to make things clear, calm, and easy to follow.

When people search for Wyoming health insurance plans, they’re usually trying to answer one of three big questions:

- How can I get affordable coverage?

- What options do I have in my state?

- Which plan is right for my life and my budget?

And honestly, those are smart questions. Wyoming is a beautiful place with wide-open spaces, but that also means fewer insurance companies and sometimes higher costs. That’s why understanding Wyoming Marketplace insurance and other choices matters so much. It helps you avoid paying more than you should and gives you the confidence to pick a plan that actually fits your needs.

In this guide, we’ll break everything down — step by step — so you never feel lost. You’ll learn how ACA health insurance in Wyoming works, how to compare plans, when to enroll, and how to save money using Wyoming health insurance subsidies. We’ll talk about things like deductibles and networks, but in a way that feels simple, like talking to a friend who actually explains things clearly.

Whether you’re looking for cheap health insurance in Wyoming, exploring short-term health insurance options, or trying to figure out if you qualify for help through the Wyoming Health Insurance Marketplace, you’re in the right place. By the end of this guide, you’ll know exactly what to do, what to avoid, and how to choose a plan that gives you peace of mind.

So take a deep breath — you’ve got this. I’m here to walk you through the entire process, one easy step at a time, and help you make smart choices that protect your health, your wallet, and your future.

Why Wyoming’s Health Insurance Works Differently Than Other States

When it comes to Wyoming health insurance, things don’t work the same way they do in bigger states. And honestly, that’s one reason why many people in Wyoming feel frustrated when shopping for coverage. But once you understand why Wyoming is different, everything starts to make a lot more sense.

One of the biggest reasons is population size. Wyoming has fewer people than almost every other state. With fewer people, there are also fewer insurance companies offering Wyoming health insurance plans. And when there’s less competition, prices can sometimes be higher. This is why you may notice that your monthly premium isn’t the same as someone living in a large city like Denver or Phoenix.

Another thing that makes the state unique is the wide open land. Many Wyoming residents live far from hospitals or clinics. Because of this, insurance companies have a harder time creating large networks of doctors. That’s why understanding Wyoming Marketplace insurance networks really matters. A plan might look good on paper but may not include the doctors or hospitals close to where you live.

But here’s some good news: even though Wyoming has fewer companies, you can still get strong coverage through ACA health insurance in Wyoming. These plans must follow strict federal rules. They cover things like doctor visits, emergency care, mental health services, medicine, and preventive checkups. So even if your choices feel limited, your benefits are still solid.

Another important thing is cost differences. A lot of people want cheap health insurance in Wyoming, and it is possible — especially if you qualify for Wyoming health insurance subsidies. Many families pay far less than they expect once subsidies are applied. Some people even pay close to $0 per month for a Marketplace plan depending on their income.

Wyoming also has unique options like the Wyoming Health Insurance Marketplace, short-term health plans, employer plans, and even a high-risk pool for people who struggle to get coverage elsewhere. Each of these choices works differently and can help different types of people — families, seniors, self-employed workers, or anyone in between.

So yes, the Wyoming system is a little different — but different doesn’t mean difficult. Once you understand the “why,” choosing the right plan becomes so much easier. And in the next section, we’ll break down each type of Wyoming health insurance option in a simple, organized way so you can see exactly what fits your life.

Types of Health Insurance Available in Wyoming

When you start looking for Wyoming health insurance, the first thing you’ll notice is that there isn’t just one kind of plan. There are several types, and each one works in its own way. Think of it like picking the right tool for the job — you want the one that fits your life, your health needs, and your budget. So let’s break everything down in the simplest way possible.

1. ACA Marketplace Plans (HealthCare.gov)

These are the most common Wyoming health insurance plans people choose. They’re sold on HealthCare.gov, which is also known as the Wyoming Health Insurance Marketplace. These plans follow federal rules and include important benefits like doctor visits, emergency care, medicines, mental health help, and preventive checkups.

Marketplace plans come in metal levels:

- Bronze (lower monthly cost, higher deductible)

- Silver (most popular because subsidies work best here)

- Gold (higher monthly cost, low deductibles)

If you want solid coverage and a good mix of cost and benefits, Marketplace plans are usually the safest choice. Many families qualify for Wyoming health insurance subsidies, which can make these plans surprisingly affordable — sometimes even close to $0 per month.

2. Off-Marketplace Plans

These are similar to Marketplace plans but sold directly by insurance companies. They don’t offer subsidies, so most people stick to Marketplace options. Still, they’re there if you want more choices.

3. Employer-Sponsored Insurance

If you work for a company that offers health benefits, you may get your insurance through your job. These plans often have good coverage and lower costs because your employer pays part of the premium.

4. Medicaid & CHIP

Medicaid helps low-income individuals, and CHIP covers children. Wyoming has strict rules for who can qualify, but for families who meet the income limits, these programs can make health care almost free.

5. Medicare for Seniors & Disabled Individuals

If you’re 65 or older or have certain disabilities, Medicare is your main option. In Wyoming, you can choose:

- Original Medicare

- Medicare Advantage

- Part D drug plans

- Medicare Supplement (Medigap)

6. Short-Term Health Insurance

If you need temporary coverage, short-term health insurance in Wyoming can help. It’s cheaper, but it doesn’t cover everything. It’s more like a backup plan than full protection, so use it carefully.

7. Wyoming High-Risk Pool (WHIP)

This option helps people who have serious medical conditions and can’t get coverage anywhere else. It’s not common, but it’s a safety net for those who need it.

Choosing from these Wyoming health insurance options doesn’t have to be stressful. Each type fills a different need, and once you understand how they work, the whole process becomes much easier.

How to Enroll in Wyoming Health Insurance (A Simple Step-by-Step Guide)

Enrolling in Wyoming health insurance might look complicated at first, but once you know the steps, it feels a lot easier. Think of this process like following a simple recipe — you just go one step at a time, and before you know it, you’re done. Whether you’re getting coverage for yourself or your family, this guide will walk you through everything you need to do.

1. Start by Visiting HealthCare.gov

Most people in the state buy their coverage through the Wyoming Health Insurance Marketplace. This is the official place where you can compare plans, check prices, and see if you qualify for Wyoming health insurance subsidies. Don’t worry — the website is simple to use, and it guides you through the process.

2. Create Your Account

You’ll need to make an account on HealthCare.gov so the system can show plans that fit your income, age, and county. It takes only a few minutes. Just add your name, email, and some basic details about your household.

3. Enter Your Personal and Income Information

This part is important because it decides how much financial help you can get. Many people are surprised to learn how much they save on Wyoming health insurance plans once subsidies are calculated. The lower your income, the more help you may receive.

4. Compare Plans Side by Side

Now the fun part begins — you get to look at your choices. The Wyoming Marketplace insurance page will show you:

- Prices

- Deductibles

- Doctor networks

- Medicine coverage

- Out-of-pocket limits

Look for a plan that matches both your budget and your health needs. If you take medications, check that they’re covered. If you live far from a hospital, make sure the plan includes nearby doctors.

5. Choose Your Plan and Enroll

Once you pick a plan, click the enroll button, review your details, and confirm everything. That’s it — you’re officially covered! Your insurance company will then email or mail your ID card.

6. Pay Your First Monthly Premium

Coverage starts only after you make the first payment. The good news is that many people pay a lot less — sometimes close to $0 — thanks to ACA health insurance in Wyoming subsidies.

7. Mark Your Calendar for Important Deadlines

Open Enrollment usually happens once a year, but if you have a major life change — like getting married, having a baby, moving, or losing other coverage — you may qualify for a Special Enrollment Period. This gives you extra time to sign up for Wyoming health insurance.

Taking these steps one at a time makes the whole process feel calm and manageable. And remember — choosing health insurance isn’t just about coverage. It’s about peace of mind, protection, and knowing you’re prepared for life’s surprises.

Wyoming Health Insurance Costs in 2025–2026 (What People Actually Pay)

When people start searching for Wyoming health insurance, the very first question they usually ask is, “How much is this going to cost me?” And honestly, that’s a fair question — nobody wants surprise bills or sky-high premiums. The good news is that understanding health insurance costs doesn’t have to feel overwhelming. Let’s break everything down in a way that’s easy, clear, and stress-free.

The truth is, the price of Wyoming health insurance plans depends on a few key things: your age, your income, where you live, and the type of plan you choose. Wyoming is a big state with small towns spread far apart, and that makes things a little different from places with large cities. Fewer hospitals and fewer insurance companies mean prices sometimes run higher. But don’t panic — most people qualify for Wyoming health insurance subsidies, which can make coverage surprisingly affordable.

Here’s something that might make you feel better: a lot of families in Wyoming pay far less than they expect. Thanks to ACA health insurance in Wyoming, many households get help that lowers their monthly premium. Some people even pay around $0 each month for a Marketplace plan. Yes, you read that right — zero dollars. It all depends on your income and household size.

Plans in the Wyoming Health Insurance Marketplace come in different levels, which also affects your cost:

- Bronze plans – Lowest monthly cost, but higher deductibles. Good if you rarely visit the doctor.

- Silver plans – The most popular option because subsidies work best here, lowering both premiums and out-of-pocket costs.

- Gold plans – Higher monthly cost, lower deductibles. Better if you visit doctors more often.

Another thing that affects price is how much care you need. If you take daily medication or have ongoing health needs, a plan with a slightly higher premium but lower deductible might save you money in the long run. But if you’re generally healthy, a cheaper plan could work just fine.

Keep in mind that some folks look at short-term health insurance in Wyoming to save money, but these plans don’t cover as much. They can be affordable but should be used with caution.

At the end of the day, your goal is simple: find a plan that fits your life, protects your health, and keeps your wallet safe. And with the right information, that becomes a whole lot easier.

Subsidies & Financial Assistance in Wyoming (How to Save Money on Your Health Insurance)

One of the biggest secrets about Wyoming health insurance is that most people don’t pay the full price. And honestly, that’s a huge relief. Health insurance can be expensive, but there are powerful financial tools that can make your plan much, much cheaper — sometimes even close to $0 per month. These savings are called subsidies, and they’re designed to help regular people afford real coverage without feeling stressed.

When you apply for a plan through the Wyoming Health Insurance Marketplace, the system checks your household size and income. Based on that information, you may qualify for Wyoming health insurance subsidies that lower your monthly premium. Think of it like getting a discount every single month — except the discount never runs out as long as you qualify.

There are two main types of financial help you can get in Wyoming:

1. Premium Tax Credits (PTCs)

These are the most common subsidies. They reduce the amount you pay every month for your Wyoming health insurance plan. The lower your income, the bigger your discount. Many families are shocked to see how cheap their plan becomes after the credit is applied. Some people pay under $20 a month. Some pay nothing at all.

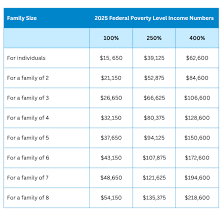

To qualify, most people need to be within a certain income range — usually between 100% and 400% of the Federal Poverty Level. But because rules have changed recently, even higher-income families can sometimes get help, especially if health insurance costs take up a big chunk of their budget.

2. Cost-Sharing Reductions (CSRs)

These help you pay less when you visit the doctor, pick up a prescription, or go to urgent care. CSRs only apply to Silver-level plans on the Marketplace, but they can save thousands of dollars a year.

If you qualify, your plan instantly becomes stronger:

- Your deductible drops

- Your copays become smaller

- Your out-of-pocket costs go way down

Many people don’t realize they’re eligible until they apply. And once they see the savings, it feels like a huge weight off their shoulders.

Why Subsidies Matter So Much in Wyoming

Because Wyoming has fewer insurance companies, prices can be higher compared to other states. That’s why subsidies matter even more here. They make ACA health insurance in Wyoming affordable for everyday families, self-employed workers, ranchers, students, retirees — anyone who needs protection without breaking their budget.

If you’re looking for cheap health insurance in Wyoming, subsidies are your best friend. They’re the key to turning a plan that seems expensive into one that feels truly manageable.

Short-Term Health Insurance in Wyoming (Fast, Flexible, but Read This First!)

If you need quick coverage while you’re between jobs, waiting for Marketplace enrollment, or simply want a temporary option, short-term health insurance in Wyoming might sound like the perfect solution. These plans are affordable and easy to get — sometimes you can be approved on the same day. But before choosing one, it’s important to understand what short-term plans actually offer and what they don’t.

Short-term plans are designed to give you temporary protection, usually for a few months. Some companies let you extend coverage up to a year, but the big benefit is speed: they work fast, and almost anyone can apply. Because these plans aren’t required to follow ACA rules, they usually cost much less than Marketplace Wyoming health insurance plans. That’s why many people see them as cheap health insurance in Wyoming.

However, the lower price comes with trade-offs.

What Short-Term Plans Usually Cover

Most Wyoming short-term health insurance plans focus on the basics. They help protect you from big medical bills if something unexpected happens, like:

- emergency room visits

- hospital stays

- major injuries

- sudden illnesses

They work best as a safety net rather than full, long-term coverage. If you just need something until your new job starts, or while waiting for ACA open enrollment, short-term insurance can fill that gap.

What Short-Term Plans Do Not Cover

This is where people often get confused. Short-term plans are not the same as ACA health insurance in Wyoming. They do not have to cover:

- pre-existing conditions

- maternity care

- mental health services

- prescription drugs (many plans skip this)

- preventive care, like wellness checkups

Because of this, short-term plans are not a good choice for anyone with ongoing health needs, chronic conditions, or families expecting a baby. These plans are meant only for short, simple situations — not long-term healthcare.

Who Should Consider Short-Term Health Insurance in Wyoming?

Short-term plans may be useful if you are:

- between jobs

- losing your employer coverage

- waiting for ACA Open Enrollment

- healthy and only need temporary protection

- new to the state and waiting to choose a long-term plan

They’re also helpful for people who missed Marketplace deadlines and need immediate coverage without waiting for a qualifying event.

When Short-Term Insurance Is a Bad Idea

If you need strong, reliable coverage that includes prescriptions, mental health care, or pre-existing condition protection, then a Marketplace Wyoming health insurance plan is usually the better choice. Subsidies often make Marketplace plans cheaper than people expect, sometimes even cheaper than a short-term plan.

Wyoming Health Insurance Requirements (What You Must Know Before You Choose a Plan)

(≈400 words | simple, friendly, emotional, keyword-rich)

When you’re trying to pick the right Wyoming health insurance, it helps to know the basic rules the state follows. Don’t worry — these rules aren’t confusing. Think of them as the “behind-the-scenes” protections that make sure you get fair, reliable coverage. Understanding these requirements gives you confidence, saves you time, and helps you choose a plan that actually supports your health.

Let’s break everything down in the simplest way possible.

Wyoming Follows Federal ACA Rules (This Is Good for You!)

Wyoming uses the federal Marketplace, meaning all ACA health insurance in Wyoming must follow the Affordable Care Act’s protections. This includes important rules like:

1. No One Can Deny You for Pre-Existing Conditions

If you have asthma, diabetes, anxiety, or any health issues, ACA plans must cover you. They cannot charge you more just because you need care.

This is something short-term health insurance in Wyoming does not offer, which is why ACA plans are the safest long-term choice.

Essential Health Benefits (Every ACA Plan Must Cover These)

Every Marketplace Wyoming health insurance plan must include 10 essential health benefits. These include:

- ER visits

- Hospitalization

- Mental health care

- Maternity and newborn care

- Prescription drugs

- Lab tests

- Preventive checkups

- Pediatric care for kids

- Outpatient visits

- Rehab services

This means you’re not buying a “bare minimum” plan — you’re buying real, complete protection.

What About Prices? Wyoming Uses Community Rating

This one’s simple: ACA plans can only adjust prices based on a few things like:

- your age

- your ZIP code

- whether you smoke

- the plan level you choose

They cannot raise your rates because of a past illness. This protects you from surprise charges.

Open Enrollment and Special Enrollment Rules

To buy ACA health insurance in Wyoming, you must enroll during:

- Open Enrollment (once a year)

- Special Enrollment Periods if you have a qualifying life change (job loss, moving, marriage, divorce, aging off a parent’s plan, etc.)

If you miss these deadlines, you may need short-term coverage until you can enroll again.

Medicaid & CHIP Requirements

Wyoming also offers Medicaid and the Children’s Health Insurance Program, but the state has stricter rules than many others. If your income is low, you may qualify for help — but the rules vary, so it’s smart to check.

Health Insurance Subsidies in Wyoming (How to Lower Your Monthly Costs)

Paying for Wyoming health insurance can feel overwhelming, especially when you’re trying to balance bills, groceries, and everything else life throws at you. The good news? Most people in Wyoming actually qualify for financial help — and many don’t even realize it. These savings are called subsidies, and they can make your monthly premium drop so much that it feels like a huge weight off your shoulders.

Let’s break it down in a way that’s super easy to understand.

What Are Health Insurance Subsidies?

Think of subsidies as discounts that help lower the cost of your ACA health insurance in Wyoming. These discounts come from the government and are based on your income, household size, and where you live.

There are two main types of subsidies:

1. Premium Tax Credits

These are the most common. They help lower the amount you pay each month for Marketplace plans.

If your income falls within a certain range, your monthly premium can drop a lot — sometimes by 70% or more.

Many families are shocked to see they qualify for cheaper Wyoming health insurance plans than they expected.

2. Cost-Sharing Reductions (CSRs)

These help lower your out-of-pocket costs, like:

- deductibles

- copays

- coinsurance

CSRs only apply to Silver-level Marketplace plans, but the savings can be huge.

Who Qualifies for Subsidies in Wyoming?

Most Wyoming residents qualify for some kind of help. You may be eligible for subsidies if:

- you purchase a Marketplace plan

- you’re not offered affordable coverage from an employer

- your income falls within the federal limits

Families with kids may also qualify for Medicaid or CHIP, which makes Wyoming health insurance even more affordable.

How Much Can You Save?

This is where things get exciting. Many people end up paying $10–$50 per month after subsidies. Some pay $0 for full-coverage Marketplace plans.

Your savings depend on:

- your household income

- your family size

- your chosen plan

- current Marketplace rates

If you’ve been searching for cheap health insurance in Wyoming, subsidies are often the easiest way to get it.

What About Short-Term Plans?

Short-term health insurance in Wyoming does not qualify for subsidies. Only ACA Marketplace plans offer financial help.

If you want long-term protection and big savings, ACA plans are almost always the smarter choice.

How to Find the Best Health Insurance in Wyoming (Simple Steps Anyone Can Follow)

(≈400 words | easy, conversational, keyword-rich, written for a 10-year-old level)

Choosing the right Wyoming health insurance can feel like trying to solve a giant puzzle. There are so many plans, prices, and benefits that it’s easy to get lost. But don’t worry — when you break the process into small steps, it becomes simple, even enjoyable. You deserve a plan that gives you peace of mind, fits your budget, and actually takes care of you when life gets tough.

Here’s the easiest way to find the best health insurance in Wyoming, without stress or confusion.

Step 1: Know What You Really Need

Before jumping into shopping, ask yourself a few questions:

- Do you visit doctors often?

- Do you take regular medications?

- Do you want low monthly costs or lower deductibles?

- Do you need coverage only for yourself or your family too?

These questions help you choose between Bronze, Silver, and Gold Marketplace plans. If you want low monthly payments, Bronze might be enough. If you want better coverage when you need care, Silver or Gold may be smarter.

Step 2: Check If You Qualify for Subsidies

Most people qualify for discounts on ACA health insurance in Wyoming.

Subsidies can make plans surprisingly affordable — even cheap Wyoming health insurance in many cases.

If you want the best price AND full coverage, always check your subsidy eligibility first. It can instantly change your options.

Step 3: Compare Plans on the Marketplace

The Marketplace shows you:

- monthly premiums

- deductibles

- out-of-pocket costs

- doctor networks

- prescription coverage

Comparing plans side-by-side helps you understand which one gives you the most value. Always review what’s covered and what’s not.

Step 4: Don’t Forget to Look at Short-Term Options

If you only need temporary coverage — maybe you’re between jobs or waiting for enrollment— consider short-term health insurance in Wyoming.

It’s not a long-term solution, but it can help protect you from big medical bills.

Just remember: short-term plans do not cover pre-existing conditions or many essential benefits.

Step 5: Choose a Plan That Matches Your Budget + Lifestyle

This step is where everything comes together. After comparing your needs, your budget, and your options, choosing the best Wyoming health insurance plan becomes easy.

Pick a plan that:

- covers your medical needs

- fits your budget

- offers benefits you actually use

- feels reliable and safe

The right plan should make you feel protected, not stressed.

Best Health Insurance Companies in Wyoming (Top Options You Can Trust)

When you’re choosing Wyoming health insurance, it helps to know which companies people in the state trust the most. A good insurance company should make you feel safe, supported, and cared for — not overwhelmed or confused. The right one will offer solid coverage, fair prices, and customer service that doesn’t leave you waiting on hold forever.

Below are some of the top providers that offer reliable Wyoming health insurance plans. Each company has different strengths, so it’s important to look at what matters most to you.

1. Blue Cross Blue Shield of Wyoming

This is one of the most popular health insurance companies in the state. Many people pick BCBS because they offer:

- strong doctor and hospital networks

- multiple ACA Marketplace plans

- good customer support

- wide coverage options

If you’re looking for full ACA coverage — including essential benefits — BCBS offers some of the most trusted ACA health insurance in Wyoming.

2. Mountain Health CO-OP

If you prefer a nonprofit option, Mountain Health CO-OP is a great choice. They’re known for:

- affordable rates

- member-focused plans

- good coverage for families

- strong support and extra benefits

Many people appreciate that CO-OP plans feel more “people-first,” making them a solid option for anyone wanting affordable Wyoming health insurance without losing quality.

3. UnitedHealthcare (Short-Term Plans)

If you’re exploring short-term health insurance in Wyoming, UnitedHealthcare offers some of the most flexible options. These plans are great if you:

- need temporary coverage

- are between jobs

- missed Marketplace enrollment

- want low monthly costs

Just remember: short-term plans are not the same as ACA Wyoming health insurance. They don’t cover essential health benefits or pre-existing conditions, but they can be helpful for quick protection.

4. Medicaid & CHIP Providers

If you qualify for Medicaid or CHIP, these programs may offer the most budget-friendly Wyoming health insurance options available. These programs focus on:

- low-income adults

- children

- pregnant women

- individuals with limited resources

Coverage varies, but the costs are extremely low — sometimes even $0.

Which Company Should You Choose?

It depends on what you need:

- Want full, strong coverage? → ACA Marketplace plans from BCBS or CO-OP.

- Need temporary insurance? → Short-term plans from UnitedHealthcare.

- Struggling with income? → Medicaid or CHIP may be your best fit.

The important thing is to choose a company that makes you feel comfortable and protected.

Wyoming Health Insurance for Low-Income Residents (Your Options for Real, Affordable Coverage)

Finding Wyoming health insurance can feel scary when money is tight. When every dollar matters, the idea of paying hundreds of dollars a month for coverage can feel impossible. The good news? Wyoming has several programs designed to help low-income individuals and families get the care they deserve — often for very low cost or even free.

You and your family should never have to choose between paying for food or getting medical care. Let’s walk through the options that can make healthcare affordable and stress-free.

Medicaid in Wyoming (Coverage If Your Income Is Low)

Medicaid is one of the most important programs for low-income residents. It provides full health insurance to people who qualify, including:

- adults with limited income

- children

- pregnant women

- families in financial hardship

- individuals with disabilities

If you meet Wyoming’s income rules, Medicaid can give you access to affordable Wyoming health insurance with very little — or sometimes no — monthly cost. Medicaid covers hospital visits, doctor checkups, prescriptions, mental health care, and many other essential services.

CHIP (Children’s Health Insurance Program)

If you have kids, this program is a huge help. CHIP offers low-cost or free health insurance to children and teens when a family earns too much for Medicaid but still can’t afford private insurance.

CHIP covers:

- doctor visits

- immunizations

- dental care

- prescriptions

- vision checkups

If your kids need reliable care, CHIP can be one of the best Wyoming health insurance plans available.

ACA Subsidies for Low-Income Families

If you don’t qualify for Medicaid, you may still be able to get ACA health insurance in Wyoming at a deeply reduced price. Many low-income households pay:

- $10–$30 per month, or

- $0 per month for full Marketplace coverage

Subsidies help lower your costs so you can get quality care without draining your wallet.

These subsidies can turn a plan that normally costs $400+ per month into one that costs almost nothing. It’s the easiest way to find cheap health insurance in Wyoming without losing important benefits.

What If You Need Temporary Coverage?

If you don’t qualify for Medicaid yet and need something fast, short-term health insurance in Wyoming can help for a short period. It’s not as strong as ACA coverage, but it can protect you from big medical bills while you get back on your feet.

You Deserve Affordable Coverage

Money shouldn’t stop you from getting the health care you need. With Medicaid, CHIP, and Marketplace subsidies, low-income residents have real, reliable options.

Wyoming Health Insurance for Seniors (Your Coverage Options Explained Simply)

(≈400 words | conversational, warm, and easy enough for a 10-year-old to understand)

As we get older, our health becomes even more important. The right Wyoming health insurance can help seniors feel safe, supported, and protected — without worrying about huge medical bills. Thankfully, seniors in Wyoming have several strong coverage options, and understanding them doesn’t have to be confusing.

Let’s break everything down step-by-step so you can feel confident and in control.

Medicare: The Main Choice for Wyoming Seniors

Once you turn 65, you become eligible for Medicare, which is the primary health insurance program for seniors. Medicare is trusted across the country because it offers broad coverage at an affordable cost.

Medicare has four main parts:

1. Medicare Part A (Hospital Coverage)

Most people don’t pay anything for Part A. It covers:

- hospital stays

- skilled nursing care

- hospice care

2. Medicare Part B (Doctor & Outpatient Services)

This covers:

- doctor visits

- lab work

- preventive care

- medical equipment

Part B does require a monthly premium, but it protects you from expensive medical bills.

3. Medicare Part D (Prescription Drugs)

If you take daily medications, Part D is important. It helps lower the cost of your prescriptions.

4. Medicare Advantage (Part C)

These plans combine Parts A, B, and sometimes D into one. Many seniors like Medicare Advantage because these plans often include:

- dental

- vision

- hearing

- fitness benefits

Medicare Advantage plans can give you a more “all-in-one” feel.

Medicare Supplement Plans (Medigap)

Even with Medicare, you may still have out-of-pocket costs. That’s where Medigap comes in. Medigap plans help cover costs like:

- deductibles

- coinsurance

- copayments

Wyoming offers several Medigap options that can make your overall coverage smoother and less stressful.

Medicaid for Low-Income Seniors

Some seniors with limited income qualify for Medicaid along with Medicare. This is called “dual eligibility.”

Medicaid can help pay for:

- long-term care

- nursing homes

- prescription costs

- Medicare premiums

For low-income seniors, this can make Wyoming health insurance much more affordable.

What About Short-Term Plans?

Short-term health insurance in Wyoming is usually not a good option for seniors. These plans don’t cover pre-existing conditions and don’t offer the protections seniors need. Medicare is almost always the safer, stronger choice.

You Deserve Peace of Mind

Seniors in Wyoming have solid coverage options — Medicare, Medigap, Medicaid, and Medicare Advantage all work together to create a safety net. With the right plan, you can enjoy your daily life with confidence, comfort, and the medical support you deserve.

Wyoming Health Insurance for Families (Protecting the People You Love Most)

(≈400 words | conversational, easy for a 10-year-old to understand)

Keeping your family healthy is one of the most important things you’ll ever do. That’s why choosing the right Wyoming health insurance for your family matters so much. You want a plan that keeps your kids safe, supports you during tough moments, and doesn’t leave you worrying about surprise medical bills. The good news? Wyoming offers strong, flexible, and affordable options for families of all sizes.

Let’s break everything down in a clear and comforting way.

Why Families Need Strong Coverage

Kids catch colds, teens get injured, adults need checkups — life happens. A good Wyoming health insurance plan helps you handle all of this without stress. With the right coverage, your family gets:

- doctor visits

- preventive care

- urgent care

- emergency services

- prescription drugs

- pediatric care

When your loved ones are protected, you feel a huge sense of relief.

ACA Marketplace Plans for Families

Most families in Wyoming get insurance from the federal Marketplace, which offers ACA health insurance in Wyoming. These plans are powerful because they include the 10 essential health benefits, covering everything from maternity care to mental health.

Even better — most families qualify for big subsidies, which can bring your monthly cost way down. For many households, ACA plans become the most affordable Wyoming health insurance option available.

If you’re looking for cheap Wyoming health insurance without losing quality, Marketplace plans are often your best choice.

CHIP: Health Coverage for Kids

The Children’s Health Insurance Program (CHIP) is a lifesaver for many Wyoming families. If your income is too high for Medicaid but still tight, CHIP provides:

- low-cost or free doctor visits

- dental and vision care

- immunizations

- prescription coverage

Kids receive strong coverage at a price families can handle.

Medicaid for Low-Income Families

If your household income is limited, Medicaid may provide full Wyoming health insurance for you and your children. It covers:

- checkups

- hospital care

- prescription drugs

- preventive care

- maternity services

The costs are extremely low — sometimes $0.

What About Short-Term Coverage for Families?

Short-term health insurance in Wyoming can help if you’re between jobs or waiting for coverage to start. But it’s not ideal for families because it doesn’t cover important things like:

- pre-existing conditions

- preventive checkups

- maternity care

It should only be used as a temporary option.

Your Family Deserves the Best

Your family is your whole world. With the right Wyoming health insurance, you can give them security, comfort, and reliable care — without breaking your budget. Whether you choose ACA Marketplace plans, Medicaid, CHIP, or temporary coverage, protection is available for every family in the state.

Wyoming Health Insurance for Self-Employed Individuals (Simple, Flexible Options for Independent Workers)

Being self-employed gives you freedom — you get to choose your own hours, build your own business, and work on your own terms. But it also means you’re responsible for your own health insurance, and that can feel scary when you don’t know where to start. Thankfully, Wyoming offers several strong options to help freelancers, contractors, and small business owners find reliable and affordable coverage.

If you’re self-employed in Wyoming, you don’t have to feel alone. Let’s walk through your best choices together.

ACA Marketplace Plans (Most Popular Choice for Self-Employed Workers)

The federal Marketplace is where most independent workers find Wyoming health insurance. Marketplace plans cover the 10 essential health benefits, making them a safe and complete option. Whether you’re a freelancer, ride-share driver, consultant, or small business owner, these plans give you full protection.

The best part?

Most self-employed people qualify for subsidies, which can dramatically reduce monthly costs. This makes Marketplace plans one of the easiest ways to get affordable Wyoming health insurance without sacrificing quality.

If you’re searching for cheap Wyoming health insurance, subsidies can make a big difference — especially when your income changes month to month.

Deducting Your Premiums

Here’s a huge benefit many self-employed workers don’t know:

You may be able to deduct 100% of your health insurance premiums from your taxes.

This means your ACA health insurance in Wyoming can become even cheaper after tax season. It’s one of the biggest financial advantages of being self-employed.

Short-Term Plans for Temporary Gaps

If your income is unpredictable or you only need coverage for a few months, short-term health insurance in Wyoming can give you quick, temporary protection. These plans are:

- fast to get

- low cost

- ideal for short periods

But remember: they don’t cover pre-existing conditions, maternity care, or many preventive services. They’re better as a backup, not a main form of coverage.

Health Insurance for Small Business Owners

If you run a small business — even a tiny one — you may qualify for Small Business Health Options (SHOP) plans. These plans allow you to offer coverage to employees, and in some cases, you may even qualify for tax credits.

This can make Wyoming health insurance plans more affordable and help your business look more professional.

Your Health Matters Too

When you work for yourself, it’s easy to take care of everyone else and forget about yourself. But your business can only succeed if you stay healthy, strong, and protected. Whether you choose an ACA Marketplace plan, a short-term plan, or a small business option, there’s a solution that fits your life.